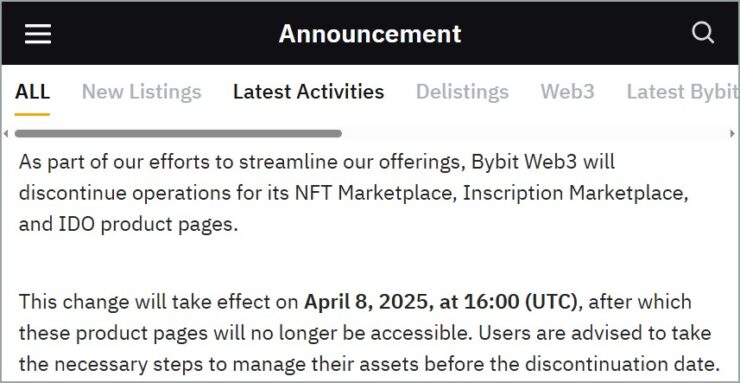

Bybit has announced it will shutter its NFT Marketplace on April 8, becoming the latest crypto platform to exit the sector as institutional support for non-fungible tokens continues to dwindle.

The move comes just five weeks after the exchange suffered a high-profile security breach, though the company framed the decision as part of a broader strategy to consolidate services and refocus on core offerings.

In a statement released on April 1, Bybit confirmed it will also decommission its Inscription Marketplace and Initial DEX Offering (IDO) pages. Users have been advised to transfer their assets from Bybit’s Web3 wallets before the cutoff date to avoid potential loss of access.

Industry Exodus Accelerates as NFT Platforms Pivot or Close

Bybit’s exit from the NFT space is the latest in a broader wave of platform closures, signaling an ongoing retreat by major players from a once-booming digital asset category. Just this week, NFT marketplace X2Y2 announced it would wind down operations after processing over $5.6 billion in total trading volume. In a statement, the platform cited the 90% drop in overall NFT trading since 2021, adding:

“Marketplaces live or die by network effects. We fought tooth and nail to be #1, but after three years, it’s clear it’s time to move on.”

The company plans to pivot its focus toward artificial intelligence.

The collapse of marketplace volume has impacted even the biggest names in the space. Kraken shuttered its NFT division in late February, while Nike-owned RTFKT ceased operations in January amid sharp declines in the value of its collections. LG, the electronics giant, also plans to sunset its NFT platform, LG Art Lab, by June 17—framing the decision as a strategic shift to “explore new opportunities.”

Once-Hyped NFT Collections Lose Momentum as Market Sentiment Sours

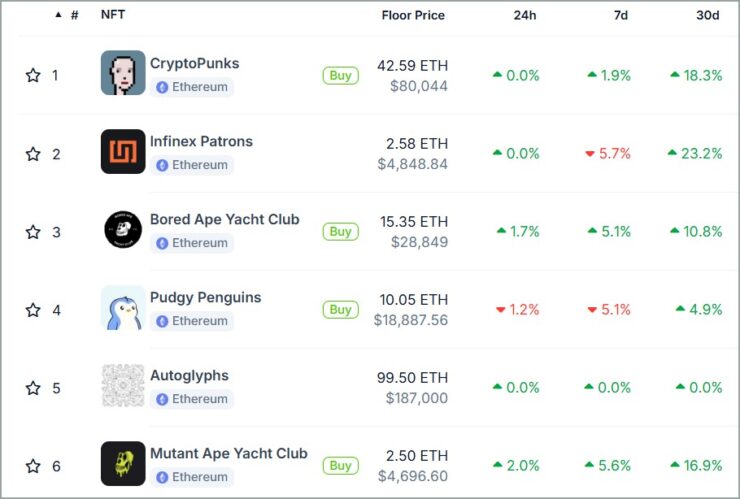

The broader NFT ecosystem continues to show signs of exhaustion, with once-iconic collections like Bored Ape Yacht Club and CryptoPunks facing steep declines in both trading volume and valuation. The speculative fervor that defined the 2021 bull cycle has given way to caution, with fewer buyers, lower floor prices, and dwindling monthly activity.

According to data from blockchain analytics firm Coingecko, trading volumes for the most prominent NFT collections have plunged by 95% since their peak. At the height of the market, over 500,000 wallets were actively trading NFTs—today, that number has fallen below 20,000.

The floor price of a CryptoPunk—long viewed as a blue-chip NFT—now sits at 42.59 ETH, down nearly 66% from its August 2021 peak of 125 ETH. Bored Ape Yacht Club has seen even steeper losses, with floor prices falling 90% from their 2022 highs, now trading at just 15.35 ETH.

While a handful of collections like Pudgy Penguins and Doodles have recently shown signs of resilience, the broader NFT market has failed to regain its former momentum. The sustained downturn raises deeper questions about the long-term utility, cultural relevance, and market structure of digital collectibles as institutional interest continues to fade.

Quick Facts

- Bybit will close its NFT Marketplace on April 8, along with its Inscription and IDO product pages.

- Users are advised to withdraw assets from their Web3 wallets before the shutdown to avoid loss.

- The closure follows similar exits by Kraken, X2Y2, RTFKT, and LG as the NFT market continues to contract.

- NFT trading volumes have declined over 90% since peaking in 2021, with institutional support continuing to fade.