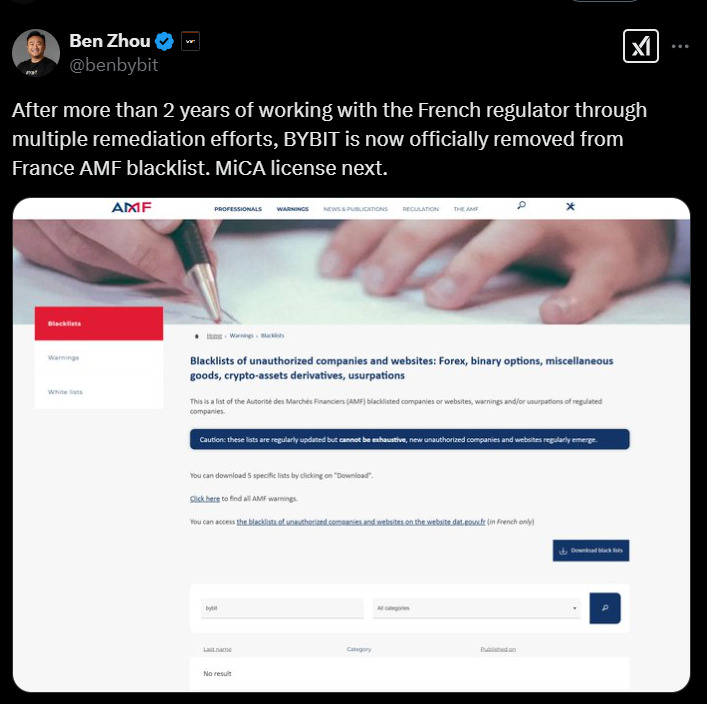

Bybit, one of the world’s leading cryptocurrency exchanges, has officially been removed from France’s Autorité des Marchés Financiers (AMF) blacklist, marking a significant development in its regulatory journey. The platform, which had been blacklisted since May 2022 due to noncompliance with local financial regulations, no longer appears on the regulator’s list of unauthorized companies and websites.

This removal comes at a time when crypto exchanges are facing increasing scrutiny across Europe, with firms rushing to align with the upcoming Markets in Crypto-Assets Regulation (MiCA) framework. Bybit’s latest move signals its commitment to regulatory compliance and expansion within the European market.

Bybit’s Exit from the AMF Blacklist

In May 2024, the AMF issued a public warning reaffirming that Bybit was a blacklisted entity. However, that same release now features a disclaimer indicating that the information is no longer up to date. While no formal statement has been made by the regulator regarding Bybit’s removal, the exchange’s absence from the blacklist strongly suggests that it has taken corrective measures to address compliance concerns.

Interestingly, despite its removal from the AMF’s blacklist, Bybit recently ceased operations in France. The exchange informed its French users that, as of January 8, it would no longer provide withdrawal or custody services, citing intensified regulatory oversight. This decision raised questions about the platform’s long-term intentions in the country.

Bybit’s Regulatory Challenges and Future Plans

Bybit’s CEO, Ben Zhou, confirmed on February 14 that the company had been actively engaging with French regulators for over two years to remediate its compliance issues. He also revealed that Bybit is now working toward obtaining a MiCA license, which would allow it to operate legally across the European Union under a unified regulatory framework.

While Bybit’s removal from the AMF blacklist is a positive step, the exchange continues to face regulatory obstacles in other jurisdictions. In Malaysia, authorities have ordered the platform to halt its operations, and in India, regulatory pressures forced Bybit to suspend its services. These ongoing challenges highlight the increasing regulatory oversight that crypto exchanges must navigate globally.

The MiCA Framework and Exchange Expansion in Europe

The European Union’s MiCA regulation, set to take full effect in 2024, has become a focal point for crypto exchanges seeking legitimacy in the region. Like Bybit, other major platforms are aligning themselves with MiCA’s requirements to expand their services within the EU.

On the same day that Bybit announced its pursuit of a MiCA license, crypto exchange Bitget revealed its intention to follow a similar path. Having secured a license to operate in Bulgaria, Bitget is now expanding its presence in Poland and Lithuania as part of its broader European strategy.

Meanwhile, major industry players such as OKX and Crypto.com have already obtained full MiCA-compliant licenses, giving them regulatory approval to operate across the bloc. Their success underscores the importance of obtaining proper authorization to sustain long-term growth in the European market.

What This Means for the Crypto Industry

Bybit’s removal from France’s AMF blacklist reflects a growing trend in the crypto industry: exchanges are prioritizing compliance to secure their place in regulated markets. While regulatory scrutiny is intensifying worldwide, exchanges that align with frameworks like MiCA stand to benefit from greater legitimacy, expanded market access, and increased investor confidence.

For Bybit, the road ahead will likely involve continued collaboration with regulators to secure a MiCA license and re-establish its presence in Europe. Whether the exchange will re-enter the French market remains uncertain, but its commitment to compliance suggests that it is positioning itself for long-term growth in the evolving regulatory landscape.