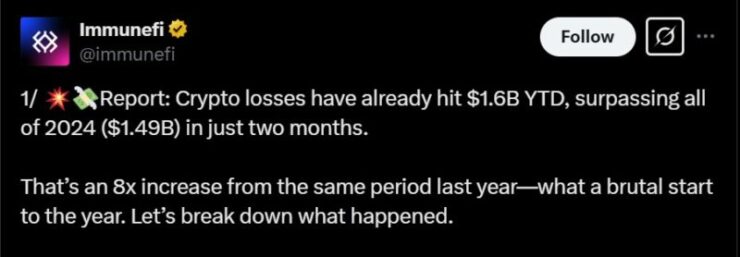

With just two months into the year, crypto hacks in 2025 are already approaching last year’s total losses of $2.2 billion, signaling a troubling trend for the digital asset industry. According to blockchain security firm Immunefi, total losses have surged to $1.6 billion, largely driven by the record-breaking Bybit exploit.

Last Friday’s Bybit hack saw over $1.4 billion worth of Ethereum and Ethereum-related assets stolen, making it the largest crypto heist in history. U.S. authorities have since confirmed that the sophisticated attack was orchestrated by North Korea’s Lazarus Group, a state-backed cybercrime syndicate notorious for targeting digital asset platforms.

Adding to the concern, February’s total crypto losses were 20 times higher than January’s, when hackers stole $73.9 million. The sheer scale of the Bybit exploit, where criminals managed to seize control of an Ethereum cold wallet during a routine transfer, has heightened fears about security vulnerabilities in centralized exchanges.

With cybercriminals becoming more advanced in their tactics, 2025 is shaping up to be one of the most dangerous years for crypto security, prompting urgent calls for stronger security measures and regulatory oversight.

Crypto Hackers Shift Focus to Centralized Platforms

The landscape of crypto security threats is evolving, with cybercriminals increasingly targeting centralized exchanges and platforms that were once considered more secure than their decentralized counterparts.

While DeFi hacks have historically dominated crypto thefts due to smart contract vulnerabilities, 2024 saw a shift toward centralized platforms, with attackers exploiting operational weaknesses in company-run exchanges. One of the largest attacks last year was the $308 million hack of Japanese exchange DMM Bitcoin, where over 4,500 BTC were stolen in May.

This year, the trend has escalated with two major centralized platforms already hit:

- Bybit suffered a record-breaking $1.5 billion theft, the largest crypto hack in history.

- Crypto neobank Infini lost nearly $50 million in an exploit on Monday, adding to the rising tally of centralized platform breaches.

These attacks have accounted for the majority of crypto losses in 2025, reinforcing the reality that no platform—centralized or decentralized—is completely immune to cyber threats. With hackers adapting their tactics, the industry is under increasing pressure to strengthen security frameworks and implement better risk management measures to prevent further losses.

Impact on the Broader Crypto Market

The Bybit incident has had a ripple effect across the cryptocurrency market, exacerbating existing downward trends. Bitcoin (BTC), the leading digital currency, has seen its price drop below $80,000 for the first time since November 2024, influenced by the hack and broader economic uncertainties, including recent tariff policies introduced by President Donald Trump.

Quick Facts:

- Bybit’s $1.5 billion hack is among the largest in cryptocurrency history.

- The FBI has linked the theft to North Korea’s Lazarus Group.

- Over $1.6 billion in crypto assets have been stolen in 2025 to date, nearing the total losses of 2024.

- The breach has contributed to significant declines in major cryptocurrencies, including Bitcoin.