In a major recovery milestone, Bybit CEO Ben Zhou has confirmed that the exchange has fully replenished the $1.4 billion worth of Ether (ETH) stolen in the Feb. 21 Lazarus Group hack. This announcement marks a critical step in reinforcing trust in centralized exchanges and their ability to bounce back from catastrophic cyberattacks.

Bybit Restores ETH Reserves to Pre-Hack Levels

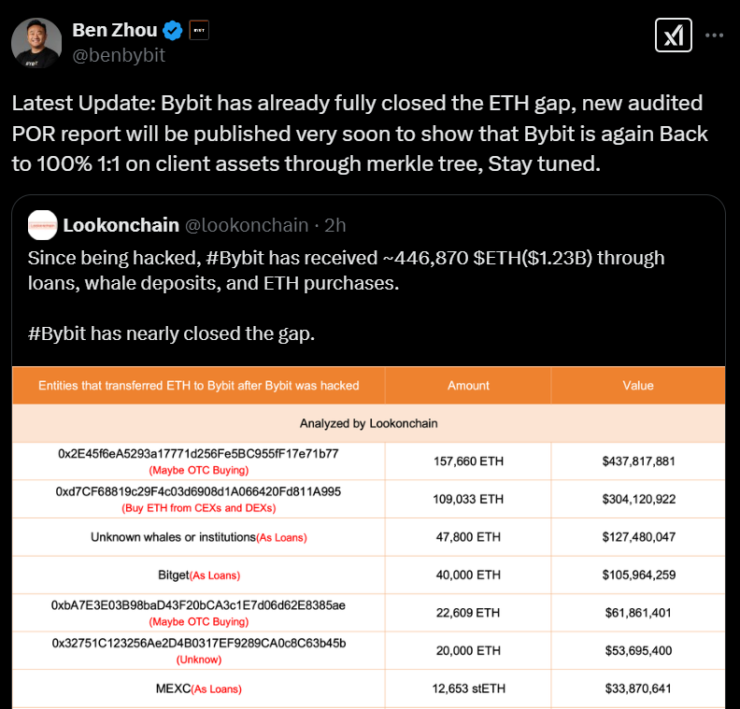

Zhou revealed that Bybit’s upcoming audited proof-of-reserve report will verify that client assets are now fully backed 1:1 through a Merkle tree verification system. The announcement, made in a Feb. 24 X post, signals Bybit’s commitment to transparency following the historic breach.

According to blockchain analytics firm Lookonchain, Bybit has received 446,870 ETH approximately $1.23 billion through a combination of loans, whale deposits, and strategic purchases. This figure represents nearly 88% of the stolen funds, closing the deficit left by the North Korean state-backed Lazarus Group.

How Bybit Rebuilt Its ETH Reserves

Lookonchain’s investigation uncovered the precise breakdown of Bybit’s ETH replenishment strategy:

- 157,660 ETH ($437.8M) was purchased over-the-counter (OTC) from Galaxy Digital, FalconX, and Wintermute via wallet address 0x2E45…1b77.

- $304M worth of ETH was purchased through centralized and decentralized exchanges, with funds traced to wallet address 0xd7CF…A995—identified as being linked to Bybit through Arkham Intelligence data.

- The first ETH purchase from the Bybit-linked wallet occurred on Feb. 22 at 4:44 pm UTC.

Arkham data further shows that the 0xd7CF…A995 wallet interacted with Binance and MEXC hot wallets, supporting the hypothesis that Bybit leveraged multiple sources to regain lost liquidity.

Largest Crypto Hack in History—Now a Recovery Success Story

The $1.4 billion Lazarus hack stands as the largest in crypto history, accounting for over 60% of all stolen funds in 2024. Despite the massive withdrawals totaling $5.3 billion on Feb. 22, Bybit’s proof-of-reserve auditor, Hacken, confirmed that the exchange’s reserves still exceed its liabilities, ensuring that user funds remain fully backed.

Bybit’s total assets now stand at $10.9 billion, per DefiLlama data—a testament to the exchange’s ability to navigate crisis and restore stability.

ETH Price Volatility and Market Impact

Following the hack, Ether plummeted over 7% in just seven hours, dropping from $2,831 to $2,629. However, the market has since rebounded, with ETH currently trading at $2,765, per CoinGecko data.

What’s Next for Bybit and the Crypto Industry?

Bybit’s rapid response and successful fund recovery reinforce confidence in centralized exchange resilience. However, the Lazarus attack highlights the ongoing vulnerabilities in crypto security, prompting discussions about future-proofing exchanges against state-backed cyber threats.

With Bybit back on solid ground, the industry will be watching closely to see how the exchange fortifies its security measures and whether decentralized solutions can mitigate similar risks in the future.

For now, Bybit’s recovery stands as one of the most remarkable comeback stories in crypto history.