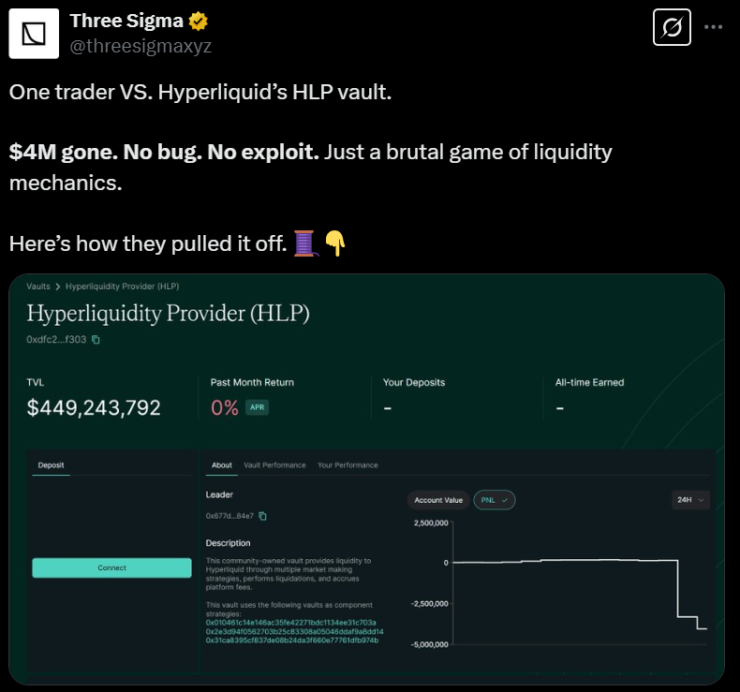

A highly leveraged trade on Hyperliquid has sent shockwaves through the crypto trading community, forcing the decentralized exchange (DEX) to shoulder a staggering $4 million loss. The event, which saw a trader manipulate liquidity mechanics to walk away with $1.8 million, has reignited concerns over risk management in derivatives markets.

Bybit CEO Ben Zhou weighed in, noting that centralized exchanges (CEXs) face similar threats but have more sophisticated mechanisms to contain such risks. His remarks highlight a crucial debate: how can platforms balance user demand for high leverage with the need for financial stability?

On March 12, an Ether whale leveraged $10 million into a jaw-dropping $270 million long position using Hyperliquid’s high-leverage trading. But there was a catch—the trader couldn’t exit without crashing their own position. Instead of triggering a catastrophic sell-off, they strategically withdrew collateral, leaving the platform itself to absorb the loss.

While some suspected a vulnerability, smart contract auditor Three Sigma confirmed it wasn’t an exploit or a hack—just an extreme example of how liquidity mechanics can be exploited under certain conditions.

Hyperliquid Scrambles to Contain Damage

In response to the incident, Hyperliquid immediately slashed its leverage limits, dropping Bitcoin leverage from 50x to 40x and Ethereum from 50x to 25x. The move increases margin requirements, ensuring that large trades have more collateral backing them—a safeguard to prevent another liquidity crisis.

Hyperliquid stated that this measure would create a more substantial buffer for liquidations, reducing the likelihood of another high-stakes maneuver devastating the platform’s liquidity.

Bybit’s Ben Zhou acknowledged that lowering leverage is a straightforward fix, but one that comes at a cost. Traders, especially those drawn to high-risk, high-reward strategies, may abandon a platform that restricts leverage too aggressively.

“I see that HP has already lowered their overall leverage; that’s one way to do it and probably the most effective one. However, this will hurt business as users would want higher leverage,” Zhou explained.

Instead, he suggested a dynamic risk limit system that reduces leverage automatically as positions grow. On a CEX like Bybit, a massive whale trade would see leverage shrink to 1.5x, significantly lowering systemic risk. However, Zhou acknowledged that traders could still bypass such limits using multiple accounts, making enforcement challenging.

Zhou also warned that even reduced leverage won’t be enough unless DEXs implement advanced surveillance measures similar to those CEXs use. He pointed out that traders could continue to find loopholes to exploit liquidity without active market manipulation monitoring.

The aftermath of the $4 million liquidation event saw a mass exodus of funds from Hyperliquid. According to Dune Analytics, the platform experienced a $166 million net outflow on March 12 alone—a sign that investor confidence has been rattled.

What’s Next for High-Leverage Crypto Trading?

The Hyperliquid event underscores a major challenge in DeFi derivatives: how to offer traders high-leverage opportunities without exposing platforms to catastrophic losses.

With centralized exchanges fine-tuning risk controls and decentralized platforms facing mounting liquidity concerns, the debate over leverage limits is far from over. Will DEXs adopt CEX-like risk frameworks, or will high-stakes trading inevitably migrate back to centralized platforms?

One thing is certain: as crypto trading evolves, platforms that fail to strike the right balance between risk and reward may struggle to retain traders in the long run.