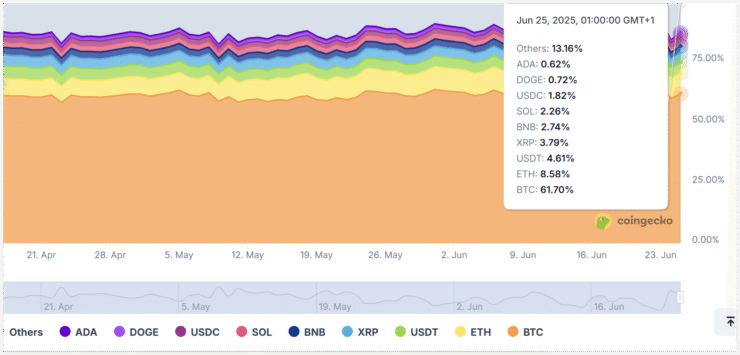

Bitcoin’s dominance has climbed back to about 62%, marking a strong rebound from its May dip to 59%. This metric, which reflects Bitcoin’s share of the total cryptocurrency market capitalization, is widely regarded as a key barometer of investor sentiment—and current trends suggest a flight to safety.

Historically, a decline in Bitcoin dominance often signals the start of an “alt season,” where traders pour capital into alternative tokens in search of higher returns. However, the recent upswing indicates that investors are moving in the opposite direction—favoring Bitcoin as a more stable and regulatory-safe bet in a volatile market climate. This shift may continue to suppress altcoin momentum and delay any broad-based rally across the sector.

Wall Street Bets on Bitcoin, Avoids Altcoins

Bitcoin’s growing dominance also mirrors evolving institutional preferences. As traditional finance slowly embraces digital assets, the overwhelming focus remains on Bitcoin and its adjacent equities. From ETFs to public company stocks, institutional exposure is flowing almost exclusively into BTC-related vehicles—leaving little appetite for riskier altcoin plays.

Firms such as MicroStrategy (MSTR), Coinbase (COIN), and Circle (CRCL) dominate the landscape of accessible crypto equities, serving as the go-to proxies for institutional crypto exposure. With limited regulatory clarity and trusted infrastructure for altcoins, large investors are opting to keep their bets concentrated in Bitcoin.

Altcoins Fragmented and Starved of Capital

A core challenge facing the altcoin sector is fragmentation. Thousands of tokens exist across dozens of blockchains, diluting capital and attention in ways that make meaningful institutional participation difficult. Without unified narratives, robust use cases, or clear legal frameworks, many altcoins remain stuck in a bear cycle.

While some projects attempt to differentiate themselves through innovation, the lack of liquidity and regulatory risk make them unattractive for large-scale investors. In contrast, Bitcoin benefits from deep liquidity, institutional products, and growing mainstream acceptance—further cementing its dominance in the current cycle.

Quick Facts

- Bitcoin dominance has surged to 62%, up from a May low of 59%.

- Institutional investors continue to favor Bitcoin and BTC-related equities over altcoins.

- The altcoin market remains fragmented, with minimal capital inflows from major financial institutions.

- This trend suggests a delayed altcoin rally as Bitcoin consolidates its position as the preferred crypto asset.