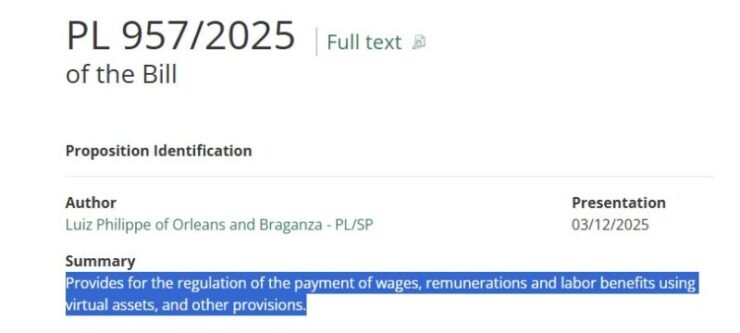

In a move that will see cryptocurrency integration into mainstream finance, Brazil’s National Congress is considering a bill permitting employees to receive a portion of their salaries in Bitcoin and other digital assets. Introduced by federal deputy Luiz Philippe de Orleans e Bragança on March 12, 2025, the proposed legislation seeks to regulate the use of digital assets for wages, remunerations, and labor benefits.

The bill outlines specific guidelines for cryptocurrency salary payments:

- Voluntary Participation: Both employers and employees must mutually agree to the cryptocurrency payment arrangement, ensuring voluntary participation.

- Payment Structure: Employers must disburse at least 50% of salaries in the Brazilian real (BRL), with the remaining portion eligible for payment in cryptocurrencies such as Bitcoin. This measure ensures that the national currency remains in active circulation.

- Exchange Rates: The conversion rate from BRL to cryptocurrency must align with the official exchange rate established by institutions authorized by the Central Bank of Brazil, promoting transparency and fairness in transactions.

- Exemptions: The bill prohibits full salary payments exclusively in virtual assets, except for cases involving expatriate employees or foreign workers, as regulated by the Central Bank of Brazil. Additionally, independent service providers may receive full compensation in cryptocurrency, subject to specific contractual provisions.

Implications for Brazil’s Cryptocurrency Landscape

This legislation could position Brazil as a pioneer in cryptocurrency adoption within the labor market if enacted. Multiple strategic objectives drive the legislative proposal. Federal Deputy Luiz Philippe de Orleans e Bragança believes integrating crypto payments can invigorate the financial technology sector and attract substantial crypto investments into the local economy.

A core aspect of the bill is to reinforce the principle of autonomy for both workers and employers. By allowing mutual agreements on compensation methods, the legislation provides greater freedom in contractual relations without compromising fundamental guarantees. This flexibility is anticipated to empower employees with more control over their earnings and promote innovative payment solutions within the labor market.

Global Inspirations and Regulatory Landscape

The proposal draws inspiration from successful implementations in countries like Japan and Portugal. In Japan, legislation requires individual agreements between employers and employees and specific guidelines for converting payments into cryptocurrencies. Portugal’s regulations have introduced flexibility, driving the adoption of virtual assets within the financial sector.

While some nations embrace cryptocurrency payments, others, such as Turkey and Russia, prohibit their use as a means of payment. El Salvador, the first country to adopt Bitcoin as legal tender in 2021, allows voluntary crypto payments but has restricted their use for tax payments and government fees following an agreement with the International Monetary Fund.

Brazil’s Strategic Positioning in the Crypto Economy

Beyond the crypto salary initiative, the Brazilian government is actively exploring cryptocurrency and blockchain technology to facilitate transactions among BRICS nations (Brazil, Russia, India, China, and South Africa).

By proposing the idea, Brazil aims to position itself as a leader in crypto adoption within the South American region and among partner states, potentially attracting foreign investment and creating more flexibility in compensation methods in the world at large.

As more countries consider similar legislation, a standardized regulatory framework for cryptocurrency transactions could emerge, providing greater security and confidence for users.

Quick Facts:

- Brazil’s National Congress is reviewing a bill allowing employees to receive up to 50% of their salaries in cryptocurrencies.

- The proposed law requires that at least half of an employee’s salary be paid in the Brazilian real’s national currency to maintain its circulation and stability.

- Similar initiatives have been observed in Argentina and the United Arab Emirates, indicating a global trend towards integrating cryptocurrencies into traditional payment systems.

- The bill aims to enhance Brazil’s position as a digital asset hub, potentially attracting foreign investment and offering employees more flexibility in compensation methods.