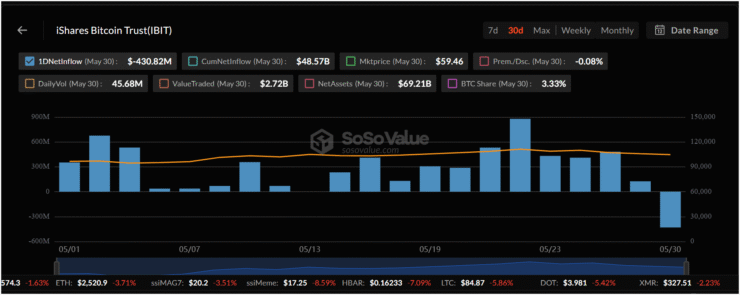

BlackRock’s iShares Bitcoin Trust (IBIT) experienced its largest-ever daily outflow on May 30, with $430.8 million in net withdrawals—bringing an end to its impressive 31-day inflow streak, according to data from SosoValue. The move signals a potential shift in institutional behavior as the broader crypto market faces fresh volatility.

This marks IBIT’s most substantial outflow since launching in January 2024, eclipsing the previous single-day record of $418.1 million set on February 26. For over a month, BlackRock had been the standout performer among spot Bitcoin ETF issuers, steadily amassing Bitcoin and pushing its holdings to nearly $70 billion.

ETF Store president Nate Geraci called the accumulation “ridiculous,” underscoring the unprecedented scale and velocity of IBIT’s growth in its first six months.

Strategic Shuffling, Not Retail Panic

The sell-off at BlackRock comes just one day after all 11 U.S. spot Bitcoin ETFs posted collective net outflows of $346.8 million on May 29. Interestingly, IBIT was the only fund that day to record an inflow, further amplifying the impact of its sudden reversal.

According to Master Ventures founder Kyle Chasse, the record outflow doesn’t point to panic. Rather, he sees it as “a shift into stronger hands,” suggesting that institutional players may be reallocating capital rather than exiting the market altogether.

“Every other issuer saw red, and BlackRock still bought. That’s big brain energy,” Chasse noted, alluding to the firm’s consistent contrarian behavior.

Price Weakness Persists Despite ETF Demand

Bitcoin continues to drift lower, trading around $103,700 as of May 31—a 2.27% drop over the previous 24 hours. This comes despite billions in ETF inflows during May, with IBIT alone absorbing over $6.2 billion, including $2.75 billion in the week ending May 23.

Nick Forster, founder of Derive, pointed out the puzzling gap between inflows and price performance. “Even with historic ETF demand, BTC can’t seem to gain momentum,” he said. Theories range from macro headwinds to accumulation by long-term holders absorbing supply without triggering major price moves.

Still, analysts remain confident that the inflows reflect long-term conviction and could lay the groundwork for a broader rally once short-term uncertainty clears.

Quick Facts

- BlackRock’s IBIT ETF saw $430.8M in outflows on May 30—its largest on record

- All 11 U.S. spot Bitcoin ETFs collectively posted $616.1M in net outflows that day

- Bitcoin traded at ~$103,700, down 2.27% in 24 hours

- Analysts attribute the shift to institutional rotation, not retail panic