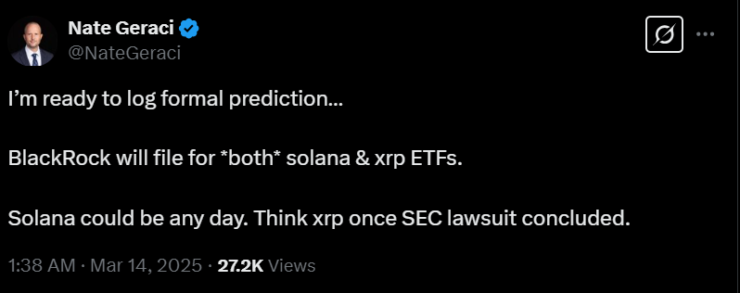

BlackRock may be gearing up to file for an XRP exchange-traded fund (ETF), but not until Ripple’s long-standing legal battle with the U.S. Securities and Exchange Commission (SEC) is settled, according to ETF analyst Nate Geraci.

The president of The ETF Store believes that once the regulatory dust settles, BlackRock will position itself to compete in the XRP ETF space, much like it has done with Bitcoin and Ethereum ETFs. However, the timeline remains uncertain, as the SEC continues to delay ETF decisions and tighten its grip on crypto regulations.

Geraci’s prediction comes just days after Franklin Templeton, a $1.5 trillion asset manager, became the largest player to enter the XRP ETF race. Before this, only smaller, crypto-native firms had filed applications, leaving institutional giants mainly on the sidelines.

The SEC’s lawsuit against Ripple has been a major roadblock for XRP’s institutional adoption, with regulatory uncertainty discouraging major asset managers like BlackRock from making a move.

While Grayscale and other firms have submitted XRP ETF filings, the SEC has delayed its decision, pushing the timeline for regulatory clarity further down the road.

BlackRock’s Cautious Approach to Crypto ETFs

While speculation is building, BlackRock has remained non-committal about launching more altcoin ETFs anytime soon.

- Samara Cohen, BlackRock’s chief information officer, recently stated that it would be “a while” before the firm expands its crypto ETF offerings beyond Bitcoin and Ethereum.

- In December, Jay Jacobs, BlackRock’s U.S. head of thematic and active ETFs, emphasized that the firm is focused on its existing crypto products, signaling no immediate plans for new altcoin ETFs.

Despite this cautious stance, Geraci argues that BlackRock will not sit back and let competitors dominate the market. If an XRP ETF gains traction with Franklin Templeton and other players, BlackRock is likely to enter the space rather than be left behind.

While XRP’s regulatory uncertainty remains a roadblock, Geraci believes that BlackRock is already considering filing a Solana ETF soon.

He predicts that a Solana ETF filing could happen any day now, positioning BlackRock as an early player in one of the fastest-growing blockchain ecosystems. Additionally, he sees the asset management giant expanding into crypto index ETFs, offering diversified exposure to multiple cryptocurrencies within a single product.

Will XRP’s Legal Resolution Open the Floodgates?

BlackRock’s entry into the altcoin ETF market could signal a major turning point for institutional crypto adoption, but only if regulatory conditions improve.

For now, Ripple’s ongoing battle with the SEC casts a shadow over XRP’s future, making it unlikely that major players like BlackRock will move until there is full regulatory clarity.

However, if Ripple secures a favorable outcome, an XRP ETF filing from BlackRock could be inevitable a move that would further cement institutional crypto adoption and reshape the future of digital asset investments.