BlackRock CEO, Larry Fink, has raised concerns about the long-term stability of the U.S. dollar’s position as the world’s reserve currency, citing rising debt levels and expanding federal deficits as critical risk factors. In his annual letter to investors, Fink argued that if the U.S. does not implement structural fiscal reforms, digital assets such as Bitcoin could emerge as serious contenders for global monetary influence.

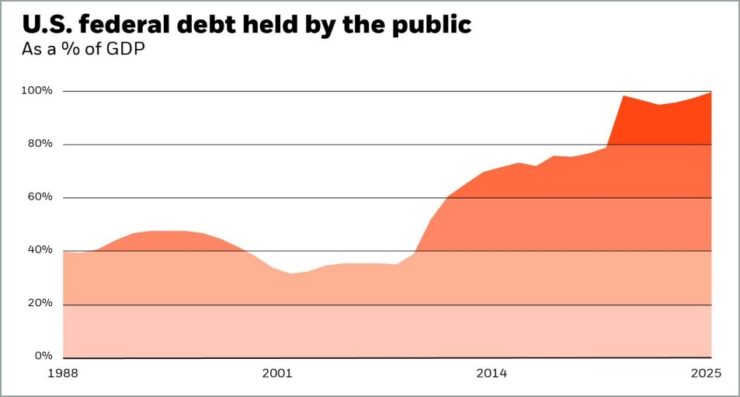

Fink pointed to the pace at which the national debt has outgrown the U.S. economy, noting that since 1989, when the national debt clock was first installed in Times Square, federal debt has expanded nearly three times faster than GDP. He warned that if this trajectory continues unchecked, the fiscal strain could significantly erode international confidence in the dollar.

“This year, interest payments will surpass $952 billion—exceeding defense spending. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit,” Fink stated.

Fink estimates that the combined cost of debt servicing and mandatory entitlement programs could consume the entirety of federal revenue, leaving the U.S. operating under a structurally permanent deficit.

“To be clear, I’m obviously not anti-digital assets,” Fink said.

“But two things can be true at the same time: Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar.”

Fink Calls Tokenization a Catalyst for Financial Transformation

In a deeper exploration of blockchain’s role in reshaping global finance, Larry Fink emphasized the transformative potential of tokenization—referring to it as a pathway to both modernization and democratization in capital markets. The BlackRock CEO contrasted today’s financial infrastructure with outdated systems like SWIFT, which he likened to a postal service in a digital age.

“It works much like a relay race: Banks hand off instructions one by one, meticulously checking details at each step. That relay approach made sense in the 1970s, an analog era when the markets were much smaller and daily transactions were much fewer,” Fink argued.

“Relying on SWIFT feels like routing emails through the postal office. Tokenization changes all that. If SWIFT is the postal service, tokenization is email itself— assets move directly and instantly, sidestepping intermediaries.”

Tokenization, in his view, represents a fundamental shift. By converting traditional assets such as stocks, bonds, and real estate into blockchain-based tokens, ownership can be verified digitally and transferred instantly without the need for intermediaries or paper-based processes. This streamlining could eliminate delays in settlement cycles, freeing up capital that’s currently locked in transition and redirecting it into productive parts of the economy.

Beyond efficiency gains, Fink highlighted tokenization’s potential to democratize investment access. Fractional ownership enabled by digital tokens can allow more individuals to invest in high-value assets that have traditionally been restricted to institutions or ultra-high-net-worth individuals—such as private equity or high-end real estate. He also noted that shareholder voting and governance could become more inclusive, with blockchain-based systems allowing secure and accessible voting from anywhere in the world.

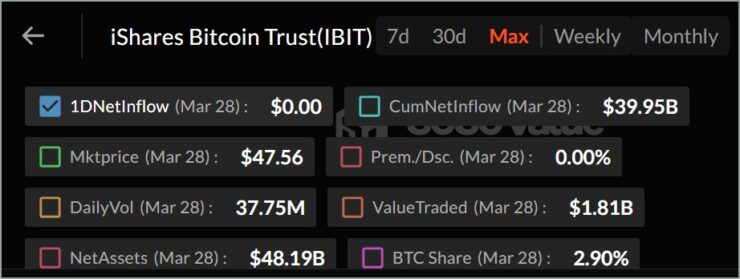

BlackRock’s Bitcoin ETF Performance

In the letter, Fink pointed to the remarkable success of the firm’s spot Bitcoin exchange-traded fund, IBIT, as a key milestone in its broader digital asset strategy. Launched in early 2024, IBIT has rapidly grown to become the largest ETF debut in financial history.

According to reports, the fund attracted more than $37 billion in net inflows last year and currently manages over $50 billion in assets—a figure that far surpasses other offerings in the same category. For comparison, Fidelity’s FBTC, the next closest competitor, has drawn in roughly $11.5 billion in net inflows since its launch.

Fink attributed the success to a growing appetite among institutional and retail investors for regulated exposure to Bitcoin, especially in an environment of heightened concern about fiat currency stability. The product’s performance has solidified Bitcoin’s standing as an asset increasingly accepted within traditional finance circles, bolstered by custodial safeguards and price transparency that institutional investors demand.

Quick Facts:

- BlackRock CEO Larry Fink warned that rising U.S. debt could jeopardize the dollar’s global reserve currency status.

- He pointed to digital assets like Bitcoin as potential challengers to traditional monetary dominance.

- Fink projected that by 2030, U.S. debt servicing and entitlement spending could consume all federal revenue.

- He also championed tokenization as a breakthrough innovation capable of modernizing and democratizing global finance.