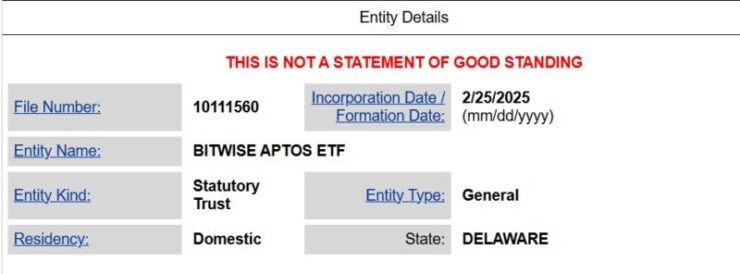

Crypto asset manager Bitwise has taken a major step toward launching an Aptos (APT) ETF, registering the Bitwise Aptos ETF as a statutory trust in Delaware on February 25, according to government records. While the filing does not confirm an imminent ETF launch, such registrations often indicate that a fund manager is preparing to file an S-1 registration with the U.S. Securities and Exchange Commission (SEC) for approval.

The registration of the Bitwise Aptos ETF entity indicates the firm’s strategy to capitalize on the growing investor interest in alternative cryptocurrencies. By establishing a statutory trust in Delaware, Bitwise lays the groundwork for a potential Aptos-focused ETF, pending regulatory approval. This initiative aligns with the company’s broader mission to provide diversified crypto investment products to meet evolving market demands.

Bitwise has been actively expanding its digital asset offerings beyond Bitcoin and Ethereum. In November 2024, the firm launched its Aptos Staking ETP across six Swiss exchanges, a move that CEO Hunter Horsley described as part of a broader trend where institutional investors are increasingly incorporating digital assets into their portfolios.

Bitwise isn’t alone in this push. 21Shares also debuted an Aptos Staking ETP in Euronext Amsterdam and Paris in November, signaling growing interest in the Layer 1 blockchain ecosystem. Meanwhile, Bitwise recently filed for a Dogecoin ETF in Delaware in January, further diversifying its altcoin investment strategy.

Escalating Competition Among Asset Managers

Bitwise’s recent filing is part of a broader trend of asset managers seeking to introduce altcoin-focused ETFs. Notably, Grayscale Investments has filed for a Polkadot ETF to be listed on Nasdaq, while Franklin Templeton has submitted an application for a Solana ETF, and Canary Capital filed for a spot Hedera (HBAR) ETF earlier this week.

This surge in altcoin ETF applications coincides with a more favorable regulatory climate under the current U.S. administration. President Donald Trump’s pro-cryptocurrency stance has fostered optimism regarding the approval of diverse crypto investment products. However, analysts still advise caution, noting that while the demand for Bitcoin and Ethereum ETFs has been substantial, the appetite for altcoin ETFs may be more limited and primarily driven by retail investors.

Aptos, the Layer-1 blockchain behind Bitwise’s latest ETF registration, launched its mainnet in 2022 and has since positioned itself as a fast and scalable alternative in the blockchain space. The network’s native token, APT, currently holds the 36th spot in global market capitalization at $3.6 billion. Despite a broader crypto market downturn, APT surged 8.9% in the last 24 hours to trade at $6.12.

Quick Facts:

- Bitwise registered the Bitwise Aptos ETF as a statutory trust in Delaware, aiming to launch an Aptos-focused exchange-traded fund.

- Asset managers like Grayscale and Franklin Templeton are also pursuing altcoin ETFs, indicating a competitive push to diversify crypto investment offerings.

- The current U.S. administration’s crypto-friendly policies may influence the approval process for these emerging investment products.

- While interest in altcoin ETFs is growing, analysts suggest that demand may be modest compared to established cryptocurrencies like Bitcoin and Ethereum.