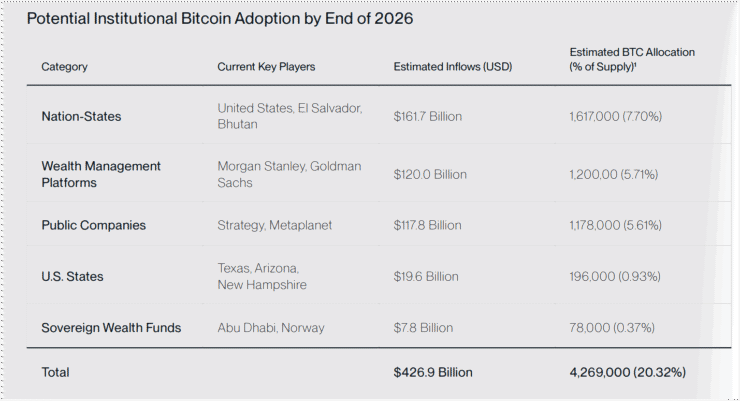

A new report from Bitwise Asset Management projects that Bitcoin could attract up to $420 billion in institutional investment inflows by the end of 2026. The forecast is rooted in a growing appetite among traditional financial players—from ETF issuers and public companies to sovereign wealth funds—for Bitcoin as a long-term reserve asset.

Bitwise anticipates that $120 billion could enter the market by the close of 2025, followed by $300 billion in 2026. The asset manager argues that Bitcoin has now crossed a crucial threshold of institutional legitimacy, evolving beyond its crypto-native origins into a broadly recognized financial instrument within regulated markets.

Bitcoin ETFs Outpace Gold’s Legacy

A key catalyst for this capital migration is the rapid rise of U.S.-listed spot Bitcoin ETFs. These funds attracted $36.2 billion in net inflows during 2024 alone, outpacing the early growth trajectory of SPDR Gold Shares (GLD)—a benchmark ETF credited with revolutionizing access to gold for institutional investors.

Since their launch in early 2024, Bitcoin ETFs have amassed $125 billion in assets under management, a figure Bitwise says represents an adoption rate nearly 20 times faster than GLD’s initial performance. If this momentum continues, Bitwise projects that annual ETF inflows could exceed $100 billion by 2027, as the instruments gain broader compliance approvals and institutional allocations.

Despite this growth, approximately $35 billion in institutional capital remained sidelined in 2024 due to internal compliance limitations and the need for longer ETF performance histories. Firms such as Goldman Sachs and Morgan Stanley, which collectively manage trillions in client assets, are said to be awaiting further data before making large-scale allocations.

Bitcoin and Gold: A New Comparison Emerges

Fidelity’s Director of Global Macro, Jurrien Timmer, reinforced Bitwise’s thesis by highlighting Bitcoin’s recent price milestone above $100,000 as a pivotal validation point. Timmer noted that Bitcoin’s risk-adjusted returns—measured through the Sharpe ratio—are now approaching parity with gold, positioning both assets as viable hedges against monetary debasement and geopolitical risk.

This convergence may prompt institutional investors to treat Bitcoin and gold as interchangeable components in inflation-hedging strategies, further solidifying Bitcoin’s reputation as “digital gold.” Analysts suggest that, over time, capital flows into Bitcoin could equal or exceed those of physical gold, particularly if macroeconomic uncertainty persists.

Bitcoin’s Supply Tightens Amid Strategic Accumulation

Beyond ETF-driven inflows, the report underscores a more structural shift in Bitcoin’s market dynamics: long-term hoarding by institutions and governments. A growing percentage of Bitcoin’s supply is being locked away as part of corporate treasury strategies or sovereign asset reserves.

According to Bitwise, publicly traded and private companies now hold over 1.14 million BTC—worth more than $125 billion. This represents nearly 6% of Bitcoin’s fixed supply and mirrors the strategic gold accumulation that defined corporate balance sheets in prior decades.

Sovereign holdings are also on the rise. Bitwise estimates that nation-states collectively hold over 529,000 BTC, valued around $58 billion at current prices. The United States leads with 207,000 BTC, followed by China with 194,000 BTC and the United Kingdom with 61,000 BTC.

This tightening of available supply, coupled with aggressive institutional interest, could serve as a powerful upward force on Bitcoin’s long-term valuation—particularly as macroeconomic tailwinds and fiscal uncertainty continue to drive demand for decentralized, non-sovereign assets.

Quick Facts

- Bitwise projects $420 billion in Bitcoin inflows by the end of 2026.

- Spot Bitcoin ETFs brought in $36.2 billion in 2024 alone.

- Public companies hold 1.14 million BTC; sovereign states hold 529,000 BTC.

- Annual ETF inflows could exceed $100 billion by 2027.