The long wait for former FTX customers is finally yielding results, as the collapsed crypto exchange has begun distributing a fresh $5 billion in repayments. This marks the second major round of distributions under the court-supervised bankruptcy process.

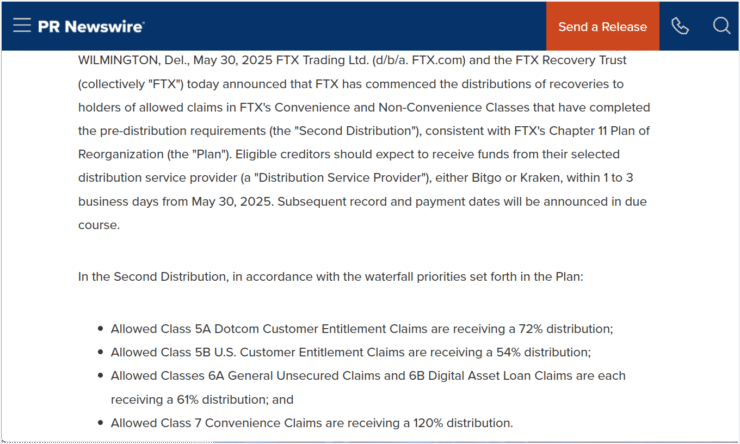

Announced Friday, the company confirmed that eligible users should expect to receive their funds within one to three business days. The disbursement is being managed by crypto custodian BitGo and exchange giant Kraken, both previously appointed as official distribution partners in the bankruptcy framework.

FTX also urged users to stay alert for potential scams, warning of phishing attempts and fake websites imitating the official customer portal.

Repayments Begin, But Users Voice Frustration

As part of its Chapter 11 reorganization, FTX Trading Ltd. began issuing over $5 billion to creditors on May 30. While the move is a milestone in the company’s ongoing bankruptcy resolution, it has triggered mixed reactions within the crypto community.

Successful recoveries from assets like FTX’s stake in AI firm Anthropic, holdings in Robinhood, and large reserves of Solana (SOL) and Sui (SUI) have enabled the estate to proceed with payments. However, the payouts are based on USD-equivalent values from November 2022—the month of FTX’s collapse—rather than the current market value of crypto assets.

This approach has sparked frustration among many users. Given the significant market rebound—especially in assets like SOL—some argue they are receiving far less than they would have if the assets were returned in-kind.

Creditors Could Recover Up to 119% with Interest

Under the current framework, FTX users will receive about 74% of their account’s USD-equivalent value during this phase of distribution, with additional rounds of repayments expected in the coming months.

For smaller creditors—classified under “convenience class” claims—returns could reach as high as 119% of approved balances, including interest.

The overall initiative is one of the largest crypto bankruptcy repayments in history, with $14.7 to $16.5 billion targeted for disbursement across multiple tranches. Payouts will vary depending on the creditor class and valuation method.

Some analysts believe this capital unlock could inject new energy into the market. As creditors begin reallocating funds, especially into volatile altcoins, it may trigger a broader uptick in trading volume across crypto exchanges.

Quick Facts

- $5 billion in FTX repayments now being distributed to creditors

- Kraken and BitGo handling disbursement under bankruptcy plan

- Payouts based on USD values from November 2022

- Creditors will get 74% of balance in this phase

- “Convenience class” users may recover up to 119%

- Estate aims to disburse up to $16.5 billion in total

- Repayments could spark fresh interest in altcoin markets