Despite hitting new all-time highs above $111,000, Bitcoin’s rally shows no sign of slowing. On-chain analytics from CryptoQuant reveal a strong dominance of buy orders over sell orders, suggesting that bullish momentum may still have room to run.

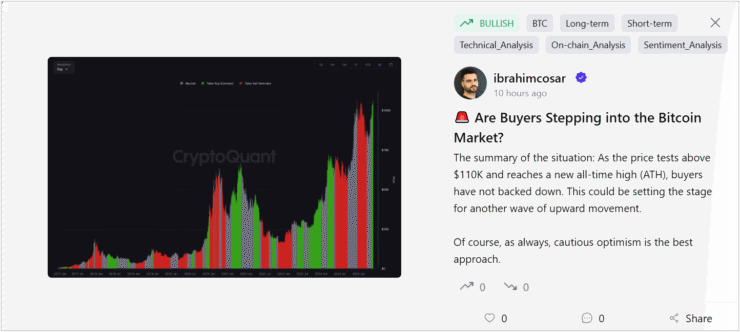

Ibrahim Cosar, a CryptoQuant researcher, pointed to the 90-day cumulative volume delta (CVD)—a key indicator tracking the net difference between aggressive buy and sell orders. Since early May, this figure has consistently favored buyers, reversing the trend of March and April when Bitcoin slipped below $75,000.

“In short: Buy orders have become dominant again. In other words, more buy orders are being placed in the market than sell orders,” Cosar explained*.*

This return of buyer control coincides with Bitcoin’s recent breakout above $110,000—a price zone it had never explored. According to Cosar, this type of buyer-led breakout at an all-time high often reflects strong market conviction and may signal further upward movement. Unlike past cycles, where price surges led to quick sell-offs, the current rally appears rooted in structural demand, not speculative euphoria.

Long-Term Holders Stay Calm Despite Record Prices

Glassnode data reviewed by Cointelegraph shows a notable difference between this rally and previous peaks: long-term holders are not rushing to sell. Even as Bitcoin crossed $111,000, activity from older coins has remained relatively low.

“Older coins were much less active this time, signaling stronger holding behavior,” Glassnode shared in a recent update on X.

This trend suggests long-term investors believe more gains lie ahead and are not treating current prices as a final exit point.

Additional support comes from CryptoQuant’s analysis of short-term holder behavior. When Bitcoin reclaimed the short-term holder average cost basis—just below $100,000—it triggered a sharp surge in momentum. Historically, this level has acted as a key support area during bull markets.

“Bitcoin is rallying after reclaiming the Short-Term Holder Average Cost basis — a key level that often serves as a strong buy-the-dip indicator during bull markets,” CryptoQuant explained.

Market Structure Suggests More Upside Possible

The current rally is being shaped by a combination of renewed buyer dominance, stronger-than-usual conviction among long-term holders, and short-term participants flipping net positive. Together, these factors suggest that Bitcoin’s momentum is underpinned by structural demand rather than short-term hype.

Unlike previous rallies that stalled amid profit-taking and weak fundamentals, this cycle shows signs of more durable investor confidence. If current trends hold, analysts say Bitcoin may still have significant upside ahead.

Quick Facts

- Bitcoin is trading above $111,000 after reclaiming key support levels

- CryptoQuant data shows buy orders dominating sell-side pressure

- Glassnode reports long-term holders are staying mostly inactive

- Short-term holder cost basis at $100K is acting as support

- Market signals point to continued bullish momentum