Crypto markets have entered a noticeable cool-off phase, with Bitcoin and altcoin trading volumes dropping sharply since early February. According to CryptoQuant, total spot trading volume for Bitcoin fell from $44 billion on February 3 to just $10 billion by the end of Q1—marking a 77% plunge. Altcoin volumes fared even worse, collapsing over 80% during the same period, from $122 billion to $23 billion.

The steep decline in volume suggests waning trader engagement, with many investors likely sidelined by uncertainty, falling prices, or expectations of more favorable conditions ahead. As volatility faded, so did speculative activity—creating a feedback loop that further thinned liquidity.

Binance Captures Liquidity as Rivals Lose Momentum

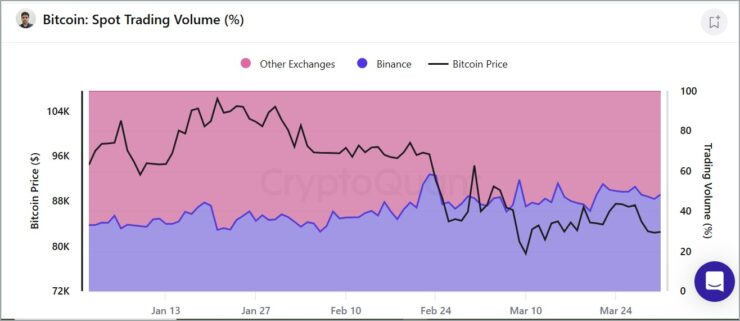

As broader market volumes dropped sharply in Q1, Binance quietly tightened its grip on crypto trading activity. The exchange’s share of total daily Bitcoin spot trading rose from 33% to 49% between February and March, underscoring its resilience amid industry-wide contraction. Altcoin spot market dominance also climbed from 38% to 44% in the same period.

This dominance suggests that while crypto volumes are shrinking across the board, Binance has weathered the pullback better than its competitors—becoming the go-to venue for traders seeking deep liquidity during turbulent conditions. The trend further solidifies Binance’s role as the industry’s primary exchange in times of heightened volatility.

Even as overall altcoin trading slowed, Binance maintained robust activity in key tokens like BNB, TON, and EOS. These assets continued to attract relatively strong interest on the platform, revealing pockets of speculative enthusiasm even in a retreating market.

Adding to this momentum, on-chain data shows a surge in Bitcoin reserves on Binance. According to CryptoQuant, BTC holdings on the platform increased by over 22,000 coins between March 28 and April 9, reflecting renewed inflows as traders reposition ahead of macroeconomic catalysts such as the upcoming CPI report.

Sustained Activity in Select Altcoins

Interestingly, certain altcoins have continued to exhibit robust trading activity on Binance despite the broader market slowdown. Tokens such as BNB, TON, and EOS have maintained relatively high trading volumes, indicating that traders still find value and opportunity within specific segments of the altcoin market.

The marked reduction in trading volumes may reflect a broader sense of caution among investors, possibly stemming from macroeconomic uncertainties or the expectation of improved entry points. However, Binance’s growing dominance—and the sustained interest in select altcoins—suggests that while the market faces challenges, there remain pockets of resilience and optimism.

Quick Facts

- Bitcoin’s spot trading volume decreased by 77% from February to March 2025.

- Binance’s share of daily Bitcoin spot trading rose from 33% to 49% over the same period.

- Altcoins like BNB, TON, and EOS continue to see significant trading activity on Binance.

- The overall decline in trading volumes may signal rising investor caution amid macroeconomic uncertainty.