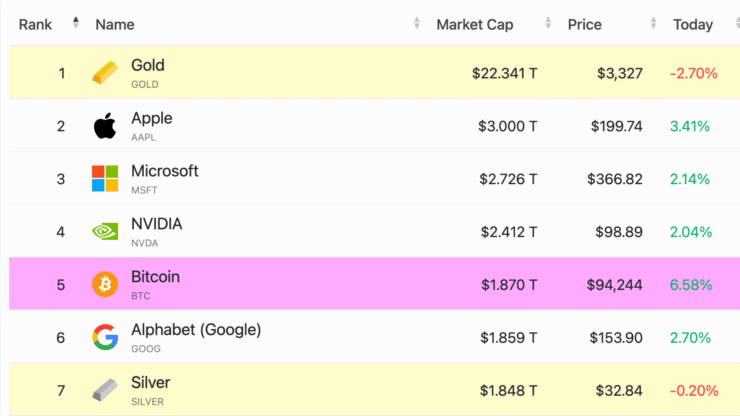

Bitcoin has officially surpassed Google in global asset rankings, climbing to the fifth-most valuable asset in the world with a market capitalization exceeding $1.84 trillion as of April 23. The milestone underscores the cryptocurrency’s evolving role in global finance, fueled by price momentum, institutional demand, and macroeconomic tailwinds.

According to data from CompaniesMarketCap, Bitcoin now outpaces Alphabet Inc. (Google’s parent company), which sits at approximately $1.82 trillion in market cap. The only assets ahead of Bitcoin are gold ($15.8T), Microsoft ($3.04T), Apple ($2.89T), and Saudi Aramco ($2.01T).

This new ranking comes amid a surge in institutional investment and growing use of Bitcoin ETFs, with U.S.-listed spot products logging their highest single-day inflows since January—$912 million. Funds from BlackRock, Fidelity, and Ark 21Shares continue to draw strong interest from traditional investors looking to gain crypto exposure without direct custody risks.

Analysts suggest that Bitcoin’s integration into traditional portfolio strategies—alongside increasing regulatory clarity and tokenization trends—has transformed it from a fringe asset into a legitimate macro hedge.

Bitcoin’s April Outperformance Signals Break from Tech Stocks

Bitcoin’s latest rally highlights a growing divergence from tech stocks, including former peers like Alphabet and Apple. While Nasdaq giants have struggled with volatility and mixed earnings, Bitcoin has maintained a steady climb, supported by ETF momentum and heightened geopolitical uncertainty.

This trend signals a deepening correlation between Bitcoin and other safe-haven assets like gold, rather than equities, which continue to face downward pressure. Analysts argue that the shift reflects broader investor sentiment that is increasingly viewing Bitcoin through a macroeconomic lens.

The rally also aligns with policy developments under the Trump administration. President Trump’s executive order exploring the creation of a Strategic Bitcoin Reserve (SBR) is currently undergoing a 60-day policy review. The initiative has stirred speculation that the U.S. could begin accumulating Bitcoin at the federal level.

Adding to the bullish backdrop are Trump’s criticisms of Federal Reserve Chair Jerome Powell and growing discussions around central bank independence, which have added volatility to traditional markets but helped boost interest in decentralized assets.

“Chatter questioning Fed independence is having positive spillover effects on BTC,” said Vetle Lunde, head of research at K33 Research.

Bitcoin Eyes Recovery Toward January Highs

Despite recent strength, Bitcoin remains about 16% below its all-time high of $109,000, set during Trump’s re-inauguration in January. However, analysts say that renewed policy clarity around the SBR, combined with easing inflation data or rate-cut expectations, could set the stage for another push toward record highs.

As Bitcoin continues to decouple from tech stocks and gain macro traction, investors are increasingly reevaluating its place in long-term strategy—not as a volatile tech proxy, but as a digital hedge in an unstable world.

Quick Facts

- Bitcoin’s market cap has reached $1.84 trillion, surpassing Alphabet (Google).

- It is now the fifth most valuable asset globally, behind gold, Microsoft, Apple, and Saudi Aramco.

- ETF inflows hit $912 million on April 22, the largest daily gain since January.

- Bitcoin is increasingly viewed as a macro hedge, with rising correlations to gold amid global uncertainty.