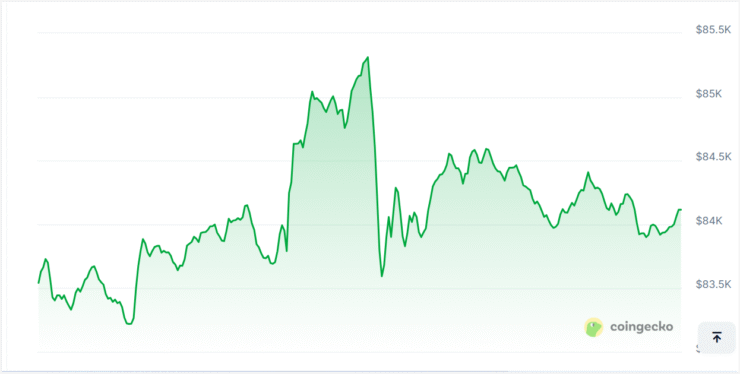

Bitcoin clawed its way back above $85,000 mid-Wednesday following a tumultuous week driven by intensifying U.S.-China trade tensions. The bounce comes after a sharp drop to $77,000 last week, sparked by the White House’s latest round of tariff announcements targeting Chinese imports.

While BTC’s daily performance flattened, the broader crypto market reflected residual anxiety—Ethereum, XRP, and Solana each dipped by up to 2%, per CoinGecko data.

Despite the short-term stabilization, analysts are sounding the alarm. According to David Duong, Head of Institutional Research at Coinbase, persistent macroeconomic uncertainty and tariff escalation could drag the market into a prolonged downturn.

“The interplay of these factors paints a difficult cyclical outlook for the digital asset space,” Duong wrote in a note Tuesday, warning that the next few weeks could prove critical for the digital asset space.

Tariff Tensions Reignite Market Volatility

According to a newly released fact sheet, Chinese goods now face up to 245% in cumulative tariffs when entering the U.S.—a combination of reciprocal duties, fentanyl-related penalties, and Section 301 levies.

The move drew an immediate rebuke from China. In a fiery op-ed, China Daily criticized the U.S. for its “capricious and destructive behavior,” urging the administration to halt its economic brinkmanship.

While President Trump hinted at progress with Japan—suggesting a bilateral trade pact is “within reach”—market sentiment remains fragile. Duong noted that inconsistent policy signals are dampening investor confidence and thinning liquidity, particularly in crypto markets where sentiment swings quickly.

Pro-Crypto White House, But Winter May Be Coming

The Trump administration’s pro-crypto posture—including initiatives like the Strategic Bitcoin Reserve and deregulation efforts—has provided a tailwind for industry sentiment. However, analysts caution that favorable politics may not be enough to offset harsh economic crosswinds.

Duong pointed to a critical technical indicator: Bitcoin’s 200-day moving average, which the asset briefly fell below during last week’s correction to $74,800. Although BTC has recovered to hover near $85,000, the breach was seen as a warning shot.

“Several converging signals may be pointing to the start of a new “crypto winter” as some extreme negative sentiment has set in due to the onset of global tariffs and the potential for further escalations,” Duong said.

While traditional markets define a bear market as a 20% decline from recent highs, crypto cycles are often more volatile and nuanced. For now, Bitcoin’s current bounce offers some relief—but not yet reassurance.

Quick Facts

- Bitcoin is currently trading near $84,000, recovering from a low of $74,800 last week.

- U.S. tariffs on Chinese goods now total up to 245%, fueling macroeconomic volatility.

- Analysts at Coinbase warn of a possible crypto winter, citing liquidity risk and weak technicals.

- Despite White House support for crypto, market sentiment remains fragile amid global trade uncertainty.