The crypto market’s brief midweek optimism was swiftly erased Friday as a sharp sell-off swept through major digital assets, pushing Bitcoin (BTC) below $84,000 and dragging altcoins into double-digit losses.

After hovering near $88,000 on Thursday, Bitcoin dropped to $83,800, reflecting a 3.8% intraday decline. The broader market followed suit, with the Broader Crypto Market Capitalization falling 5.7%, marking one of the steepest daily drops in recent weeks. Over $115 billion in market value was wiped out in less than 24 hours, according to TradingView.

The downturn also saw Ethereum (ETH) deepen its relative slide against Bitcoin, now at its weakest ETH/BTC ratio since May 2020. ETH declined more than 6% on the day and continued underperforming amid dwindling investor interest. Notably, spot Ethereum ETFs have failed to register net inflows since early March, while Bitcoin ETFs brought in over $1 billion during the same period, according to data from Farside Investors.

Altcoins were hit particularly hard in the rout, with tokens like Avalanche (AVAX), Polygon (POL), Near (NEAR), and Uniswap (UNI) losing nearly 10% each as panic selling accelerated across major exchanges. The sell-off has reignited concerns about market fragility, especially as macroeconomic signals remain mixed and institutional flows appear concentrated in Bitcoin over broader crypto exposure.

Crypto’s Drop Mirrors Wall Street Slide as Inflation Data Stokes Stagflation Fears

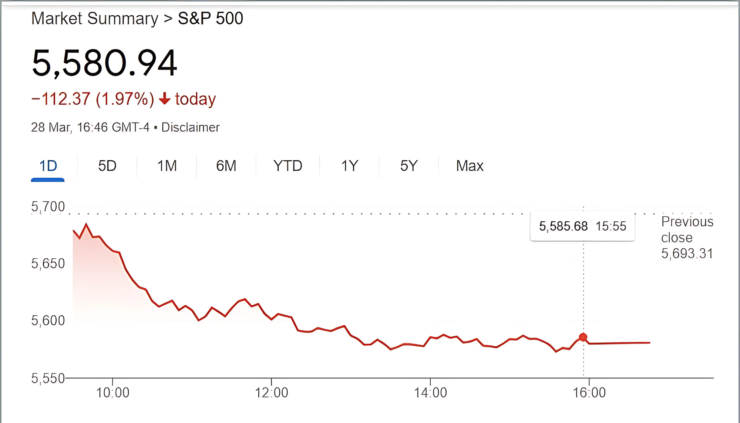

Friday’s sharp decline in crypto prices did not occur in isolation. The downturn coincided with a broader sell-off across U.S. equity markets, driven by a weaker-than-expected economic outlook and renewed inflation concerns.

The S&P 500 shed 1.9%, while the Nasdaq Composite slumped 2.8%, both pressured by a disappointing February PCE inflation report that showed core inflation rising 2.8% year-over-year—slightly above economists’ projections. Meanwhile, consumer spending rose just 0.4%, and after adjusting for inflation, the data suggested that real growth was stagnant.

Adding fuel to investor anxiety, the Federal Reserve Bank of Atlanta’s GDPNow model slashed its Q1 forecast, now estimating the U.S. economy could contract 2.8%, or 0.5% when adjusted for gold trade distortions. The outlook has intensified chatter around stagflation—a rare and troubling mix of stagnant growth and persistent inflation.

Crypto-focused equities followed suit. MicroStrategy (MSTR), the largest corporate holder of Bitcoin, saw its shares tumble 10%, while Coinbase (COIN) closed down 7.7%, reflecting the broader unease among investors exposed to digital asset markets.

Market sentiment was further strained by anticipation surrounding the Trump administration’s April 2 “Liberation Day” tariffs, a sweeping trade measure that could ripple across global markets. With risk appetite fading, crypto appears once again tightly tethered to macroeconomic signals—a reality investors must increasingly factor into short-term positioning.

Quick Facts:

- Bitcoin (BTC) fell to $83,800, wiping out weekly gains with a 3.8% drop, while the broader market lost over $115 billion in value.

- Ethereum (ETH) underperformed, falling more than 6% and hitting its weakest BTC ratio since May 2020, with spot ETH ETFs seeing zero net inflows since early March.

- Altcoins including AVAX, POL, NEAR, and UNI plunged nearly 10% as panic selling hit major exchanges.

- The sell-off reignited concerns over market fragility, with investor flows favoring Bitcoin ETFs amid growing macroeconomic uncertainty.