Quick Facts:

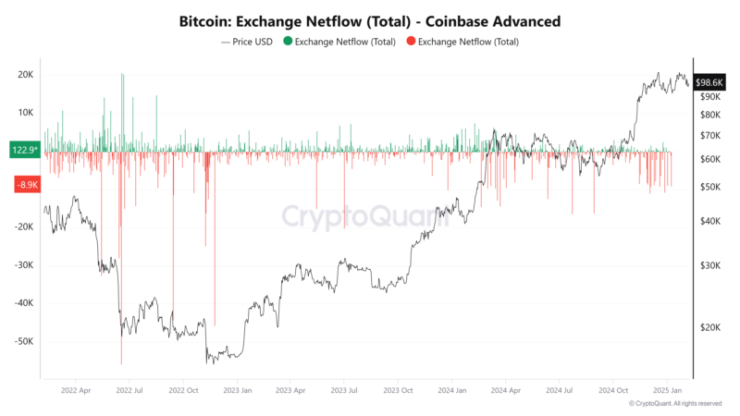

- Over 17,000 BTC, worth $1.6 billion, left centralized exchanges on Wednesday, marking the largest single-day outflow since April 2024.

- Coinbase alone accounted for 15,000 BTC in net withdrawals, signaling significant institutional accumulation.

- Analysts consider large exchange outflows a strong bullish indicator, as investors typically move Bitcoin into cold storage for long-term holding.

Bitcoin recorded its largest single-day exchange outflow since April 2024, with over 17,000 BTC—worth approximately $1.6 billion—leaving centralized exchanges on Wednesday. The move, led by massive withdrawals from Coinbase, is widely viewed as a bullish signal, suggesting that whales and institutional investors are shifting their holdings into long-term storage.

The sheer scale of Bitcoin withdrawals has caught analysts’ attention, with Coinbase alone accounting for more than 15,000 BTC in net outflows. Historically, large exchange outflows are considered a strong indicator of institutional accumulation, as investors move funds into cold storage rather than keeping them on exchanges for short-term trades.

Market analysts suggest that this trend mirrors past cycles where major outflows preceded significant price rallies. With Bitcoin hovering above $100,000, the shift in supply dynamics could further tighten liquidity, fueling potential upside momentum in the coming weeks.

Growing Confidence in Bitcoin’s Long-Term Value

On-chain data from CryptoQuant reveals that crypto exchanges collectively recorded a cumulative negative netflow of 47,000 BTC on Wednesday, marking one of the largest single-day withdrawals in months. Coinbase alone accounted for 15,800 BTC in net outflows. Analysts note that such large outflows are typically a sign of long-term conviction, as investors anticipate continued bullish momentum in the digital asset market.

Bitcoin briefly dipped below $96,800 during late U.S. trading hours on Wednesday, before recovering early Thursday following comments from Eric Trump. The son of President Donald Trump publicly encouraged the World Liberty Financial to make its first Bitcoin investment, a move that sparked renewed buying pressure in the market.

As of now, Bitcoin is trading at $99,094, showing a 0.9% gain over the past 24 hours. Ethereum (ETH) is currently at $2,812.75, up 0.5%, while XRP trades at $2.45, showing a 3.6% decline. Solana (SOL) has fallen 2.7% to $200.60, and Binance Coin (BNB) is trading at $580.04, registering a 0.9% increase.