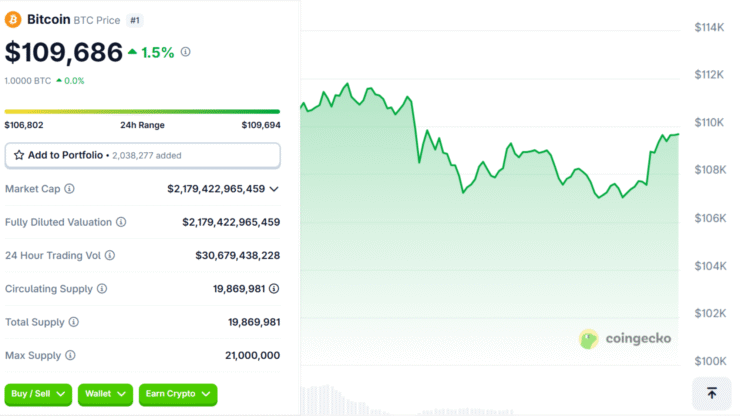

Bitcoin surged back above $109,000 on Sunday night after President Donald Trump announced a delay to the proposed 50% tariff on European Union imports, offering a short-term reprieve for both crypto and traditional markets.

Following a weekend call with European Commission President Ursula von der Leyen, Trump agreed to push the tariff deadline to July 9 to allow for further trade negotiations. The move follows weeks of shifting rhetoric, with Trump previously floating rates of 20%, 10%, and finally 50%.

The decision sparked gains across U.S. equity futures. The S&P 500 rose 0.9%, the Dow added 0.8%, and the Nasdaq-100 climbed 1%. Bitcoin led the crypto rally, hitting $109,600, while Ethereum and Solana posted moderate gains, reflecting improved investor sentiment.

Though the delay doesn’t remove the risk of a trade war, markets embraced the breathing room, setting the stage for a volatile but optimistic start to the week. Traders now look to July’s deadline as a key pivot point.

Tariff Talks, EU Strategy, and Market Calm

The European Union, which exported more than $600 billion in goods to the U.S. last year, is weighing its response. After previously pausing countermeasures on $23 billion in U.S. goods, the EU is reportedly considering broader retaliatory tariffs that could affect up to $95 billion in exports if negotiations break down.

Despite these risks, the crypto market remained relatively steady over the weekend. Ethereum hovered near $2,550, while Solana and Avalanche each gained 1–2%, signaling cautious optimism rather than aggressive risk-on behavior.

Eyes on Inflation, Flows, and Fed Signals

This week’s key focus will be Friday’s U.S. core PCE inflation report—a primary gauge for Federal Reserve decision-making. Traders will also track ongoing institutional flows into crypto, as ETF demand and regulatory developments continue to shape sentiment.

Market participants remain highly responsive to macro headlines, particularly at the intersection of inflation, monetary policy, and geopolitics. Any new signals from Washington or Brussels could quickly shift momentum.

Institutions Signal Long-Term Confidence in Bitcoin

In the face of these short-term jitters, institutional sentiment remains constructive. In a Friday note, Singapore-based QCP Capital described the current market structure as more resilient than in previous speculative cycles.

“The broader backdrop continues to skew bullish,” QCP wrote.

“A more accommodating U.S. regulatory environment, coupled with persistent institutional inflows via both ETFs and direct spot allocations, is fostering structural demand.”

This ongoing blend of regulatory clarity and professional capital inflows appears to be giving Bitcoin a firmer base—helping to support prices even as macro tensions rise.

Quick Facts

- Bitcoin rebounded to $109,600 after Trump delayed EU tariffs.

- Tariff deadline extended to July 9 after talks with EU leaders.

- U.S. stock futures rose alongside crypto in relief rally.

- Ethereum and Solana posted moderate weekend gains.

- Institutional inflows and Friday’s inflation data now in focus.