Bitcoin has staged a modest 8% rebound after briefly dipping below $79,000, as some investors rushed to buy the dip. The recovery pushed the leading cryptocurrency back above $85,000, though it remains 18% lower than a month ago and significantly off its all-time high of $109,000, set in mid-January.

The bounce comes amid broader market uncertainty, with risk-on assets struggling following a clash between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskyy at the White House. The geopolitical tensions have added to existing macroeconomic concerns, leaving Bitcoin and traditional markets in a fragile state.

Despite the rebound, many analysts remain skeptical about Bitcoin’s near-term outlook, cautioning that macroeconomic pressures and investor sentiment could drive further volatility.

Meanwhile, Robert Kiyosaki, the author of Rich Dad Poor Dad, remains bullish on Bitcoin, calling the latest dip a buying opportunity.

“Bitcoin is on SALE. I AM BUYING. The problem is not BITCOIN. The problem is our monetary system and our criminal bankers.”

Kiyosaki further warned that the U.S. is financially insolvent, stating:

“America’s bankrupt. Our debt, including social programs like Medicare and Social Security, along with our $36 trillion debt, is over $230 trillion.”

While some investors see Bitcoin as a hedge against failing monetary policies, others warn that the cryptocurrency’s short-term trajectory remains uncertain as macroeconomic conditions continue to evolve.

Altcoins Mirror Bitcoin’s Rebound

In tandem with Bitcoin’s 8% recovery, the broader cryptocurrency market has experienced a notable resurgence, with several major altcoins posting significant gains.

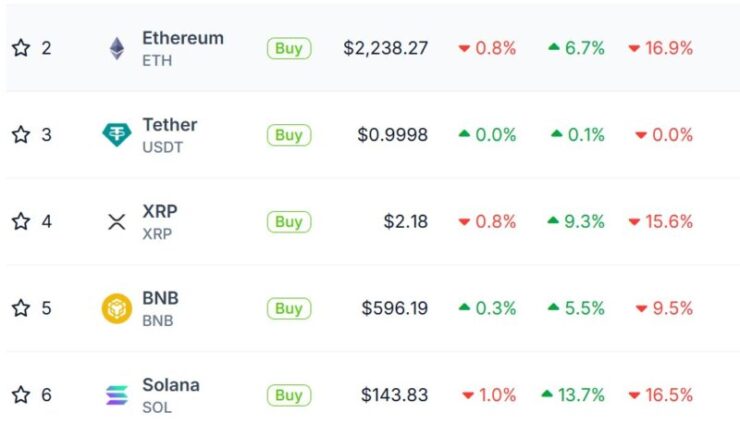

Ethereum (ETH) Climbs 6%

Ethereum, the second-largest cryptocurrency by market capitalization, has risen by approximately 6% over the past 24 hours, trading around $2,264. This rebound follows a recent dip, with ETH hitting a low of $2,076.17 before recovering.

Ripple (XRP) Surges Over 9%

Ripple’s XRP token has experienced a surge of over 9.2%, reaching approximately $2.40. This increase is part of a broader positive trend for XRP, which saw a nearly 300% rise in 2024.

Solana (SOL) Leads with 16% Jump

Solana has emerged as one of the top performers, registering a substantial 16% increase. This surge coincides with news that the CME Group plans to launch Solana futures on March 17, pending regulatory review by the Commodity Futures Trading Commission (CFTC).

Market Context

Earlier this week, the cryptocurrency market was hit by a sharp sell-off as investors reacted to rising inflation concerns, escalating trade tensions fueled by Trump administration tariffs, and broader macroeconomic instability. The risk-off sentiment has driven a retreat from major digital assets, mirroring volatility in traditional financial markets.

Adding to market jitters, last Friday’s record-breaking $1.4 billion hack of Bybit has further dampened confidence, leading to steep losses across the board. The breach—one of the largest in crypto history—has amplified concerns about security risks in centralized exchanges, prompting further outflows from digital assets.

Quick Facts:

- Bitcoin’s recovered 8% from an overnight low below $79,000 to over $84,500.

- Geopolitical tensions and macroeconomic uncertainties have contributed to increased volatility across financial markets.

- Experts note the resilience of Bitcoin but caution about ongoing fragility in broader risk sentiment.