Bitcoin briefly touched a four-month high of $105,500 on Monday before retreating sharply, following news of a partial suspension of U.S. tariffs on Chinese imports. After ranging near the $104,000 level over the weekend, the initial optimism surrounding the tariff announcement fueled a brief rally across risk assets—including crypto. However, the bullish momentum proved short-lived.

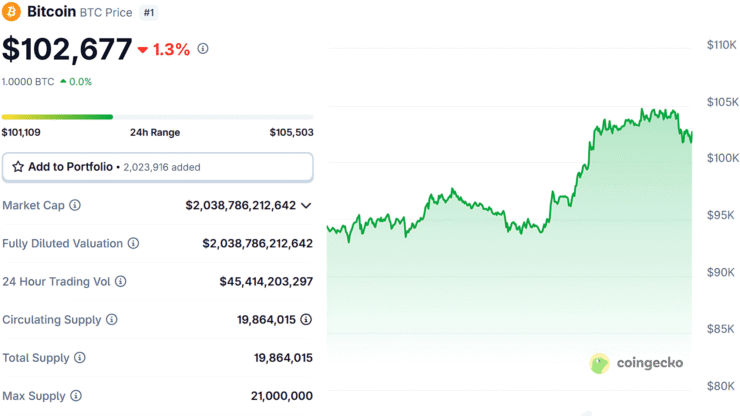

By midday, Bitcoin had pulled back to approximately $102,600, marking a 1.5% decline over the past 24 hours, according to CoinGecko. The retracement reflects lingering investor caution, given that the tariff easing is limited to a 90-day window and does not represent a long-term policy shift.

Ethereum also gained early in the session, briefly approaching $2,600 before slipping to around $2,490. Despite the intraday reversal, ETH remains up 1% on the day and has outperformed Bitcoin over the past month, posting a 51% gain in the last 30 days.

Other major altcoins showed mixed but mostly positive movement. Solana rose 2%, Cardano added 4%, and Dogecoin continued its rally with a 1.4% daily increase—bringing its weekly gains to an impressive 37%. The broader crypto market continues to track macroeconomic signals, mirroring volatility seen in traditional financial markets.

U.S.–China Tariff Pause Sparks Cautious Optimism Across Markets

Following weekend negotiations, the U.S. and China agreed to temporarily reduce their retaliatory tariffs—from 125% to 10% for a 90-day period—while broader trade discussions continue. The move marks a significant de-escalation in trade tensions that had recently unsettled global markets.

Investor concerns had mounted over the potential inflationary effects of prolonged tariff hikes and their broader economic impact. While the temporary truce lacks long-term commitments, traders view it as a positive development and a possible stepping stone toward more comprehensive trade reform.

Markets also reacted positively to signs that the U.S. may be softening its approach toward other trading partners. Just last week, the Trump administration announced a new trade agreement with the United Kingdom, although specific terms have yet to be disclosed.

The short-term tariff rollback has helped improve investor sentiment, fueling renewed appetite for risk assets.

Markets Rally as Bitcoin Gains Safe-Haven Appeal

U.S. equities surged on Monday as risk sentiment improved. The Nasdaq jumped 3.4%, while the S&P 500 rose 2.4%, extending a rally that has added over 7% to both indexes since late April.

Bitcoin, which has climbed roughly 21% over the past month, is increasingly being viewed as a hedge against global uncertainty—mirroring behavior typically associated with traditional safe-haven assets like gold.

“Investor sentiment may find further support from rising political engagement with crypto,” said Joe DiPasquale, CEO of BitBull Capital.

He pointed to Vice President JD Vance’s upcoming keynote at Bitcoin Vegas on May 28 as evidence that digital assets are becoming a central topic in mainstream economic and political conversations.

Quick Facts

- Bitcoin touched $105,500 before falling back to $102,600, down 1.5% on the day.

- Ethereum briefly neared $2,600 before settling at $2,490, up 1% on the day and 51% over the month.

- U.S. and China agreed to a 90-day reduction in tariffs, easing them from 125% to 10%.

- The Nasdaq and S&P 500 rose 3.4% and 2.4%, respectively, on renewed trade optimism.

- Vice President JD Vance is set to speak at Bitcoin Vegas 2025, signaling deeper political engagement with crypto.