According to several crypto analysts and executives, Bitcoin’s recent price dip is no cause for alarm, who argue the correction is part of the asset’s natural cycle rather than a sign of the bull run ending.

With Bitcoin down around 24% from its January peak, market watchers believe the long-term upward trend remains intact, with macroeconomic conditions temporarily delaying the cycle’s top.

Since hitting an all-time high of $109,000 in January, Bitcoin has retraced, trading near $82,000. However, analysts describe this as a standard correction phase comparable to prior cycles. Ben Simpson, CEO of Collective Shift, noted that Bitcoin has seen only a handful of 25%+ pullbacks this cycle, fewer than in past bull runs.

“I don’t think the bull run is over; I think the peak of the cycle has been pushed back due to macro conditions, and global liquidity isn’t pretty, which isn’t helping crypto,” Simpson told Cointelegraph

Derive founder Nick Forster echoed the same sentiment, emphasizing that Bitcoin has historically experienced multiple such corrections during broader rallies, suggesting that the cycle’s peak is still ahead.

“Historically, Bitcoin experiences these types of corrections during long-term rallies, and there’s no reason to believe this time is different,” he said.

Macroeconomic Conditions Impacting Price Action

Recent trade policies have heightened global economic uncertainty. President Donald Trump’s announcement of new import tariffs from Canada, Mexico, and China sparked fears of a global trade war, leading to increased market volatility.

These developments have negatively impacted investor confidence, contributing to sell-offs in both traditional and cryptocurrency markets.

Also, the Federal Reserve’s stance on interest rates is a critical factor affecting Bitcoin’s price. As of the latest meeting, there is a 99% probability that the Fed will maintain current interest rates between 4.25% and 4.50%, with only a 1% chance of a rate cut.

This cautious approach has reduced liquidity in risk assets like cryptocurrencies, as higher interest rates often make traditional investments more attractive.

Investor sentiment has been further dampened by significant sell-offs in major technology stocks, which have historically correlated with Bitcoin’s performance. The S&P 500 recently closed down 8.6% from its February 19 record high, shedding over $4 trillion in market value.

This broader market downturn has spilled over into the cryptocurrency space, leading to decreased demand and lower prices for digital assets.

Independent Reserve CEO Adrian Przelozny pointed out that the correction isn’t isolated to crypto—global markets are reacting to the same macroeconomic pressures, influencing Bitcoin’s trajectory.

Analysts Split on Short-Term Outlook

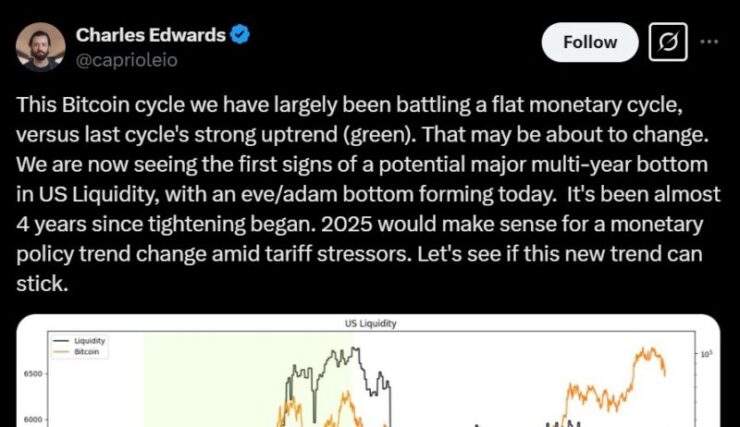

While many experts remain bullish long-term, opinions are mixed on Bitcoin’s short-term direction. Charles Edwards of Capriole Investments described the odds of the bull run continuing as “50:50,” depending heavily on whether central banks, particularly the U.S. Federal Reserve, ease monetary policy in the coming months. Liquidity conditions and rate cuts could trigger a sharp resurgence, he suggested.

Conversely, CryptoQuant CEO Ki Young Ju recently warned that Bitcoin may be entering a period of sideways or bearish price action for the next 6-12 months.

Quick Facts:

- Bitcoin has retraced 24% from its all-time high of $109,000, trading near $82,000.

- Analysts view the correction as part of Bitcoin’s natural bull cycle, not the end of the rally.

- Macroeconomic factors like U.S. rate policy and global liquidity are influencing market conditions.

- Opinions vary: some expect a new rally if liquidity increases, while others predict sideways action over the next several months.