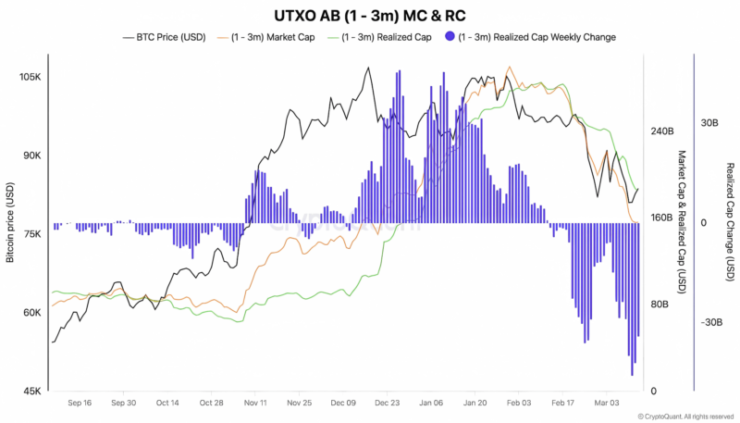

Recent data from on-chain analytics firm CryptoQuant reveals that Bitcoin speculators have suffered over $100 billion in losses over the past six weeks, with many short-term holders (STHs) exiting their positions at a loss.

The research highlights that investors who held Bitcoin for one to three months were the hardest hit, as the market underwent a significant drawdown from its recent highs.

The report shows that the market capitalization of these short-term holders’ BTC holdings is now lower than their realized capitalization, indicating that they are selling their Bitcoin at a loss. This pattern suggests that panic selling has contributed to downward price pressure, preventing BTC from reclaiming its previous highs.

Despite these short-term setbacks, institutional investors and long-term holders (LTHs) continue to accumulate Bitcoin, reinforcing confidence in its long-term value. CryptoQuant’s research notes that large-volume entities capitalize on the dips, using corrections as entry points for additional accumulation.

.“However, as this cohort exits, it could also clear a supply overhang, creating an opportunity for long-term holders to accumulate at lower prices,” the report said.

Bitcoin’s Market Correction and Its Broader Implications

February and early March have proven challenging for new Bitcoin buyers, with BTC/USD dropping nearly 30% from its recent all-time high. Analysts believe this correction is part of a broader market recalibration, with some suggesting that Bitcoin’s recent surge past $94,000 in early March was due for a cooldown.

While strong recoveries typically follow bull market corrections, CryptoQuant’s latest weekly report warns that this particular correction could be more prolonged than usual. Factors such as macroeconomic uncertainty, regulatory scrutiny, and speculative trader exhaustion may contribute to weaker bullish momentum in the short term.

Regulatory and Macroeconomic Uncertainty Add Pressure

Bitcoin’s price drawdown coincides with broader macroeconomic and regulatory pressures. Concerns over Federal Reserve rate policies and inflation data have made investors hesitant, as expectations for an imminent rate cut diminished following stronger-than-expected economic indicators. Rising interest rates often strengthen the U.S. dollar, making risk assets like Bitcoin less attractive in the short term.

Additionally, U.S. regulators continue to stall decisions on key crypto-related policies, including approving altcoin ETFs for assets like Solana (SOL) and XRP.

The Securities and Exchange Commission (SEC) has delayed multiple crypto ETF filings, further contributing to uncertainty in the market. This lack of distinct regulatory clarity has led to increased volatility, with many traders exiting their positions and anticipating further setbacks as the Trump administration approaches 100 days in office.

Despite the short-term bearish sentiment, Bitcoin’s long-term adoption remains strong, with major institutions continuing to hold and accumulate BTC as part of their treasury strategy. Companies like Strategy and Metaplanet maintain significant Bitcoin reserves, underscoring confidence in its long-term value proposition.

Quick Facts

- Bitcoin traders have realized over $100 billion in losses in the past six weeks, primarily due to panic selling by short-term holders.

- CryptoQuant’s data shows that many traders exited at an average loss of 7-9% per transaction, adding downward price pressure.

- Macroeconomic uncertainty contributed to the sell-off, including fears of the Federal Reserve rate hike and SEC delays on crypto ETFs.

- Long-term holders continue accumulating BTC, with on-chain data showing record levels of supply held by investors with strong conviction.