Bitcoin’s next major breakout hinges on reclaiming $106,000, a key resistance level that traders say could unlock a new wave of price discovery. As volatility grips the market, analysts warn that failing to hold crucial support could send BTC tumbling toward $85,000 before the next rally.

Bitcoin Must Clear $106K to Enter Price Discovery

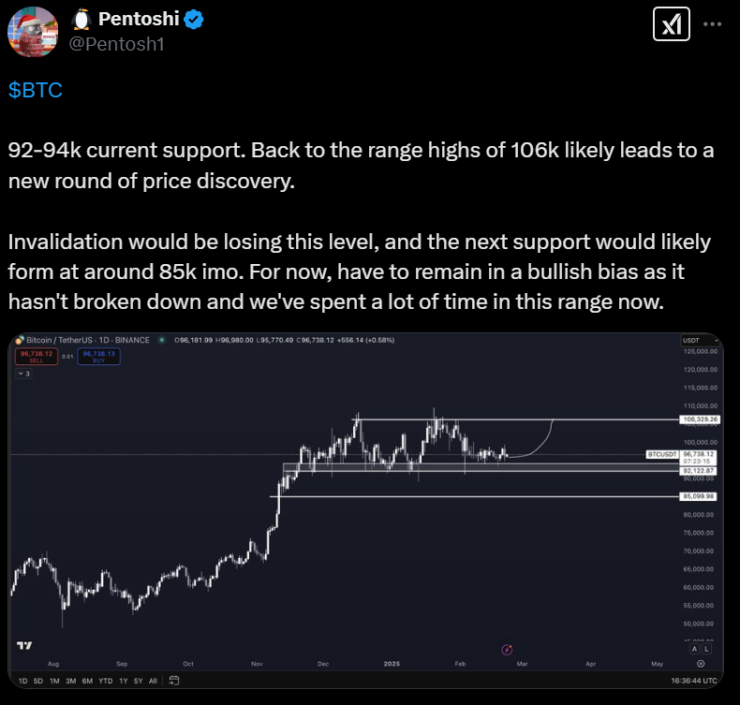

According to pseudonymous trader Pentoshi, Bitcoin pushing past $106,000 a 13% jump from current levels would likely trigger a new phase of upside momentum.

“Back to the range highs of 106k likely leads to a new round of price discovery,” Pentoshi wrote in a Feb. 22 X post.

Key Support Levels: Will Bitcoin Retest $85K?

While optimism surrounds BTC’s ability to reclaim $106K, traders remain wary of a potential downside move. Pentoshi cautions that if Bitcoin falls below the $92,000-$94,000 range, the next strong support sits around $85,000—a level BTC hasn’t seen since Nov. 12.

This aligns with earlier bearish predictions. Crypto analyst AlejandroBTC hinted at a possible return to $85,000, while BitMEX co-founder Arthur Hayes predicted an even steeper pullback toward the $70,000-$75,000 range a move he believes could trigger a “mini financial crisis.”

Too Soon to Predict Bitcoin’s Next Move?

Despite short-term uncertainties, some traders see opportunities forming. Mister Crypto, who has 136,200 X followers, revealed that he’s eyeing $90,000 as his ideal re-entry point for a major trade.

Donny, another crypto trader, agrees that Bitcoin’s chart structure remains intact but warns that patience is key:

“BTC seems well constructed. The context is crucial here, and the next few weeks will be telling.”

Meanwhile, AshCrypto remains bullish, predicting a new all-time high by March, citing historical trends. CoinGlass data reveals that March has delivered an average return of 13.42% since 2013.

Long-Term Outlook: Bitcoin’s Path to $1.5 Million

While traders debate short-term price action, some investors are focused on Bitcoin’s long-term trajectory.

ARK Invest CEO Cathie Wood has raised her forecast, stating that BTC is now even more likely to hit $1.5 million by 2030.

“We actually think the odds have gone up that our bull case will be the right number because of what is becoming the institutionalization of this new asset class,” Wood said.

What’s Next for Bitcoin?

As Bitcoin continues to consolidate near $96K, all eyes are on the $106K breakout level. A successful push past this barrier could fuel a new wave of price discovery, while a failure to hold key supports could bring another round of sharp declines.

With March historically favoring bullish trends, the next few weeks will be critical in determining Bitcoin’s trajectory, whether it soars to new highs or retreats toward lower supports.