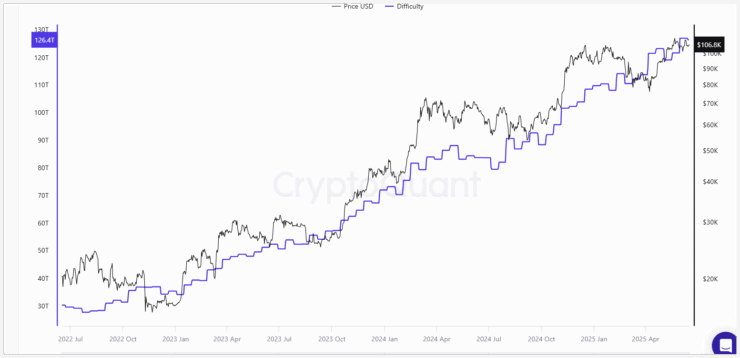

Bitcoin’s mining difficulty has slightly decreased, offering brief relief to miners under growing economic strain. As of the latest adjustment, the difficulty now stands at approximately 126.4 trillion—just below the all-time high of 126.9 trillion set on May 31, according to CryptoQuant.

While the decline appears marginal, it points to subtle shifts in an increasingly competitive ecosystem. Mining difficulty adjusts roughly every two weeks and determines how hard it is to discover a valid hash and mine a new block. As difficulty increases, so does the need for more computational power—raising costs for miners across the board.

The landscape has become especially challenging post-halving. Following Bitcoin’s April 2024 halving event, block rewards were slashed by 50%, pushing operational costs up while compressing profitability. Miners are now contending with record-breaking hashrates, reduced margins, and high capital requirements—factors forcing smaller or less efficient operations to scale down or shut off entirely.

Though this difficulty drop doesn’t reverse Bitcoin’s long-term network growth, it signals a temporary recalibration—one shaped by miner attrition and the fragile economics of post-halving mining.

Public Mining Firms Expand Despite Tight Margins

While many miners are scaling back to stay afloat, publicly traded companies are ramping up—viewing Bitcoin as a long-term strategic asset rather than just revenue.

Marathon Digital Holdings (MARA) recently reported a 35% increase in BTC production for May, mining 950 BTC and bringing its total holdings to 49,179 BTC. This production jump came even as network hashrates soared to new highs and price volatility persisted.

Rather than selling newly mined coins, Marathon—and others like it—are holding onto their reserves, treating BTC as a treasury asset. The move reflects increasing confidence in Bitcoin’s long-term value and provides a hedge against fiat dilution or financial shocks.

These firms are also riding a wave of infrastructure growth. The Bitcoin network surpassed 1 zetahash per second in April—an unprecedented leap in raw computing power that underscores the high-stakes environment of modern mining. Despite the pressure, large miners like Marathon are opting to expand, not retreat.

Miners Increase Output but Hold Their Coins

Public mining firms are also changing how they handle profits. Instead of selling rewards to fund operations, they’re stockpiling BTC, viewing it as digital gold.

Marathon CFO Salman Khan confirmed the company’s new strategy in a June 3 post on X: “Record production month for MARA — and we sold zero Bitcoin.” The decision to hold all 950 BTC mined in May underscores this shift toward long-term accumulation.

CleanSpark, another major player focused on sustainable mining, followed suit. The company boosted its output by 9% in May, producing 694 BTC, and raised its hashrate to 45.6 EH/s. With 12,502 BTC now in reserve, CleanSpark is reinforcing the broader narrative: institutional miners are betting big on Bitcoin’s future value by locking in their coins.

Quick Facts

- Bitcoin’s mining difficulty dropped slightly to 126.4 trillion, easing pressure on miners after hitting an all-time high in late May.

- Post-halving challenges and rising energy costs are forcing smaller mining operations to scale down or exit the market entirely.

- Public miners like Marathon and CleanSpark are expanding production and stockpiling BTC, treating it as a long-term treasury asset.