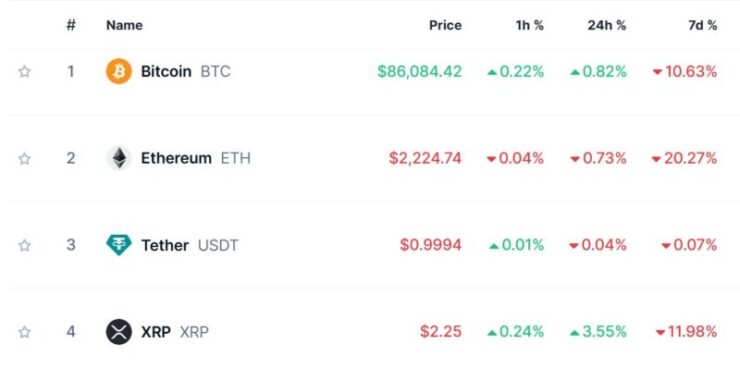

The cryptocurrency market is experiencing a notable rebound, with Bitcoin (BTC) surpassing the $86,000 mark. This resurgence coincides with President Donald Trump’s announcement of the inaugural White House Crypto Summit, signaling potential shifts in both market sentiment and regulatory landscapes.

Bitcoin has rebounded to $86,000 after a $400 billion market wipeout that pushed prices to $78,000. This recovery is reflected in the broader market, with the major altcoins also showing signs of recovery in the past 24 hours.

The Crypto Fear & Greed Index, a metric assessing market sentiment, has improved from extreme fear levels of 10 to 20, indicating a gradual restoration of investor confidence.

While Bitcoin (BTC) continues its upward trajectory, the altcoin market has also shown some resurgence.

Ethereum (ETH), the second-largest cryptocurrency, is struggling to regain momentum, currently priced at $2,230.18, with a 0.40% decline in the last 24 hours, despite a slight 0.14% gain in the past hour.

XRP and BNB are seeing solid recoveries, with XRP surging 4.16% in the past 24 hours to $2.27, while BNB has climbed 2.27% to reach $610.00.

Meanwhile, Solana (SOL) is experiencing mild volatility, currently trading at $144.51, reflecting a 0.27% increase in the last 24 hours and a stronger 1.07% jump in the past hour.

On the meme coin front, Dogecoin (DOGE) has seen a modest 1.35% gain in the past day, now trading at $0.2075.

Anticipation Builds for White House Crypto Summit

President Trump’s forthcoming White House Crypto Summit, scheduled for March 7, is generating significant interest. The event aims to bring together prominent industry figures, including founders, CEOs, and investors, to discuss the future of digital assets in the United States.

David Sacks, appointed as the White House AI and Crypto Czar in December 2024, will lead the summit alongside Bo Hines, executive director of the President’s Working Group on Digital Assets. The summit is driven by the Trump administration’s commitment to fostering innovation within the cryptocurrency sector while addressing regulatory considerations.

Trump’s administration has overseen a major regulatory retreat, with the U.S. Securities and Exchange Commission (SEC) dropping lawsuits against major crypto firms, including Coinbase and MetaMask developer Consensys. Additionally, the SEC has closed investigations into Robinhood, Gemini, Uniswap Labs, and OpenSea, signaling a more lenient regulatory approach compared to the previous administration.

This shift in enforcement has fueled optimism within the crypto industry, as market participants anticipate friendlier policies that could drive innovation and institutional adoption in the United States.

BlackRock’s Strategic Inclusion of Bitcoin

Adding to the momentum, BlackRock, the world’s largest asset manager, has introduced a Bitcoin ETF allocation into its model portfolios. The firm has allocated 1% to 2% of its iShares Bitcoin Trust (IBIT) into one of its managed models, which guides investment and rebalancing strategies for financial advisors and platforms.

BlackRock’s decision marks a major milestone in the institutional adoption of Bitcoin ETFs, potentially driving fresh demand from traditional investors. As of December 31, 2024, BlackRock’s model portfolios collectively managed approximately $150 billion in assets, making even a small Bitcoin allocation highly significant for market exposure.

Quick Facts:

- BTC has climbed back above $86,000 after a recent dip to $78,000, reflecting a 3% increase over the past 24 hours.

- President Trump will host the first-ever Crypto Summit at the White House on March 7, featuring key industry stakeholders.

- BlackRock’s inclusion of its spot Bitcoin ETF in a model portfolio signifies growing institutional interest in cryptocurrency investments.