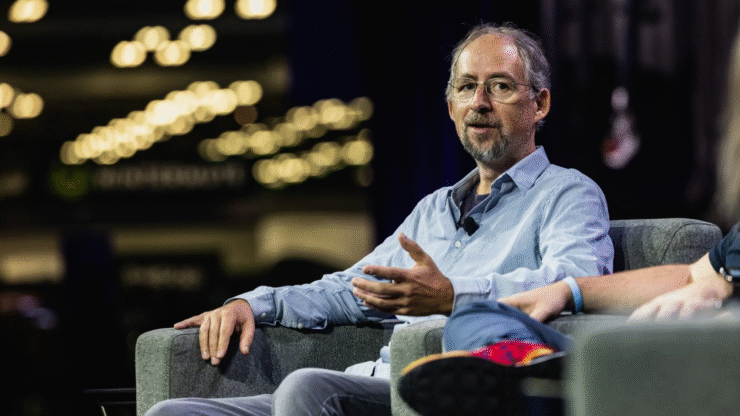

Bitcoin is grossly undervalued and could soar to staggering new heights in the coming months, according to Blockstream CEO and early Bitcoin advocate Adam Back. In a recent interview with Decrypt, Back expressed strong conviction that Bitcoin’s current market price fails to reflect the asset’s underlying strength—especially in the face of mounting institutional investment.

With Bitcoin hovering just below its all-time high near $109,000, Back argues the cryptocurrency is only in the early stages of its four-year cycle rally. He believes a price between $500,000 and $1 million per coin is well within reach before the current cycle concludes.

Back, known for his cryptographic contributions and early support of Bitcoin, pointed to the growing tide of institutional inflows and mainstream acceptance as key drivers that have yet to be fully priced in.

“I’m thinking this cycle could get quite high, but the cycle stretches out a few years, right? So I was thinking $500,000 to $1 million, because there’s a lot going on,” Back said.

“There doesn’t seem to be a clear logical reason to me for why we are only at $100,000. That’s not very high given all of the things that are different compared to a couple years ago.”

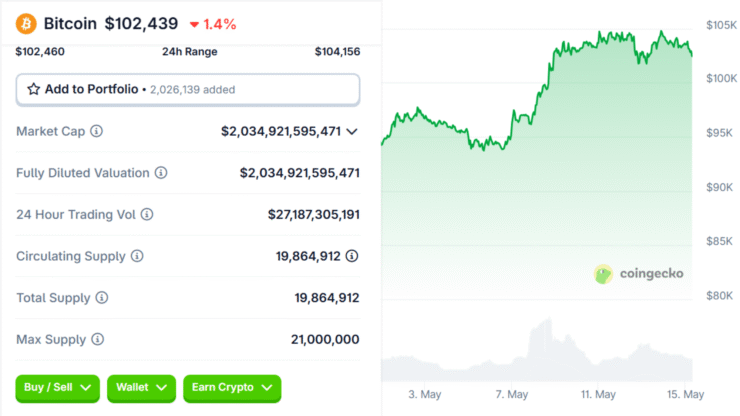

At the time of his comments, Bitcoin had climbed over 7% on the week, trading around $102,000—roughly 5% below its all-time high according to Coingecko Data. Despite a brief lull in momentum earlier in the year, the market appears to be regaining strength, with analysts noting a sharp pickup in demand from both retail and institutional players.

Back’s remarks echo a growing belief among seasoned crypto veterans that the digital asset is entering a new phase of global significance—one that could radically reshape its valuation over the next 12 to 18 months.

Spot ETFs and Politics Could Boost Bitcoin Further

Adam Back attributes much of Bitcoin’s current strength—and its potential for explosive growth—to the convergence of two critical forces: the recent launch of U.S.-regulated spot Bitcoin ETFs and a shifting political landscape that favors digital assets.

Back pointed out that the approval of spot Bitcoin exchange-traded funds by the U.S. Securities and Exchange Commission marked a turning point for mainstream crypto adoption. These ETFs, managed by financial powerhouses like BlackRock and Fidelity, have opened the floodgates for institutional and retail investors previously unable or unwilling to navigate crypto exchanges. Since their debut, the funds have pulled in over $41 billion in net inflows, reflecting a massive influx of capital into the Bitcoin ecosystem.

This institutional exposure, Back argues, is only beginning to show its long-term impact. As Bitcoin’s price climbs and crosses into new all-time high territory, the psychology of retail investors and traditional brokers tends to shift.

“I think if you get a new all-time high, it could quickly become a lot higher,” he said.

He also highlighted the favorable regulatory sentiment expected under a potential second Trump administration, which has recently been more vocal about supporting digital asset innovation. That political tailwind, paired with Wall Street’s structural support, could generate the kind of market environment where Bitcoin enters a phase of exponential growth.

As co-founder and CEO of Blockstream, a company at the forefront of Bitcoin infrastructure, Back has not only witnessed Bitcoin’s evolution—he helped shape it. His invention of the Hashcash proof-of-work system laid the groundwork for Bitcoin mining, and he remains one of the few known individuals to have corresponded directly with Bitcoin’s anonymous creator, Satoshi Nakamoto.

Quick Facts

- Adam Back believes Bitcoin is undervalued even at $100K.

- He predicts Bitcoin could reach $500K–$1M this cycle.

- Spot Bitcoin ETFs have brought in over $41 billion in inflows.

- Back cites political and institutional support as bullish catalysts.