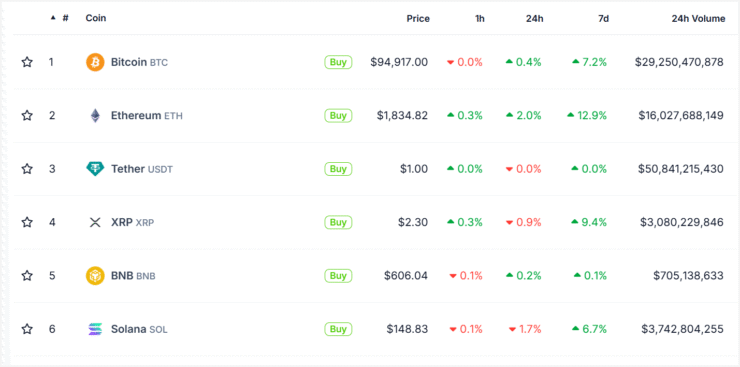

Bitcoin and major altcoins maintained relative stability over the past 24 hours, as exchange-traded funds (ETFs) tracking Bitcoin attracted over $590 million in fresh inflows on Monday. The momentum extended a six-day streak of net positive flows, marking the first full week of ETF inflows since late March.

According to market data, BlackRock’s iShares Bitcoin Trust (IBIT) led the surge with $970 million in inflows, while Ark Invest’s ARKB fund faced $200 million in outflows, suggesting shifting investor preferences within the Bitcoin ETF landscape. Bitcoin remained resilient above the $94,000 level during Asian trading hours on Tuesday — a key resistance zone that analysts believe, if breached, could open the door to a rally toward $100,000.

One trader noted optimism for Bitcoin’s medium-term outlook, citing expectations of monetary and fiscal easing policies in response to ongoing global economic pressures, including tariff-driven slowdowns. Bitcoin’s narrative as a safe-haven asset continues to gain traction amid macro uncertainty, boosting institutional interest through regulated investment vehicles like ETFs.

Broader Market Flat Despite Bitcoin’s Institutional Tailwinds

While Bitcoin drew attention with its ETF-driven momentum, the broader cryptocurrency market showed little movement. Ethereum (ETH), XRP, Cardano’s ADA, and BNB Chain’s BNB all traded flat over the past day. Solana’s SOL slipped by almost 2%, reflecting some sector-specific profit-taking despite general market steadiness.

Meanwhile, Monero (XMR) posted a sharp correction, falling 8.5% after a dramatic 40% surge on Monday. The spike was linked to a major fund movement involving $330 million worth of Bitcoin being swapped into Monero by a hacker, as reported by blockchain investigator ZachXBT.

Despite isolated volatility in certain tokens, overall market sentiment remains cautiously optimistic, particularly given the sustained institutional inflows into Bitcoin investment products.

Macro Factors Continue to Drive Crypto Market Narrative

Traders are increasingly focused on upcoming economic data releases and global monetary policy signals. Expectations of stimulus measures aimed at counteracting the economic drag from tariffs and slowing global trade are fueling bullish sentiment across risk assets, including Bitcoin.

At the same time, Bitcoin’s ability to hold its current price range — combined with its growing role in institutional portfolios — could provide stronger price support as traditional financial systems seek alternatives amid shifting macroeconomic conditions.

Beyond ETF inflows, some traders are closely monitoring broader monetary indicators — particularly the growth of the M2 money supply — as a potential catalyst for Bitcoin’s next major move. Recent viral posts have drawn attention to the apparent correlation between rising M2 levels and Bitcoin’s price performance, fueling speculation that a delayed breakout could be imminent.

M2 supply, which measures the total liquid money available in an economy — including cash, checking deposits, savings accounts, and other easily accessible capital — is often viewed as a proxy for inflationary pressures. Historically, when M2 expands significantly, investors tend to seek assets like Bitcoin as a hedge against currency debasement. Conversely, a contraction in M2 could signal reduced risk appetite, putting downward pressure on Bitcoin and other risk assets.

While the narrative has gained popularity across social media, analysts caution against overstating its immediate impact. Augustine Fan, head of insights at SignalPlus, told CoinDesk that although rising M2 could support Bitcoin’s bullish case, the relationship is not necessarily linear or instantaneous.

“One of the recent and prevailing narratives suggests that BTC is about to break higher as a delayed reaction to the increase in M2 money supply,” Fan noted.

However, he added that broader economic dynamics and investor sentiment still play crucial roles in shaping market outcomes.

As ETF inflows continue to build momentum and Bitcoin consolidates at critical technical levels, the stage appears set for potentially significant price moves in the weeks ahead.

Quick Facts

- Bitcoin ETFs attracted over $590 million in inflows on Monday, marking six consecutive days of positive net flows.

- BlackRock’s IBIT led inflows with $970 million, while Ark’s ARKB posted $200 million in outflows.

- Bitcoin remained steady above $94,000, with analysts eyeing a potential breakout toward $100,000.

- Broader altcoins, including ETH, XRP, and ADA, traded flat, while Solana’s SOL dipped 2% and Monero (XMR) fell 8.5%.