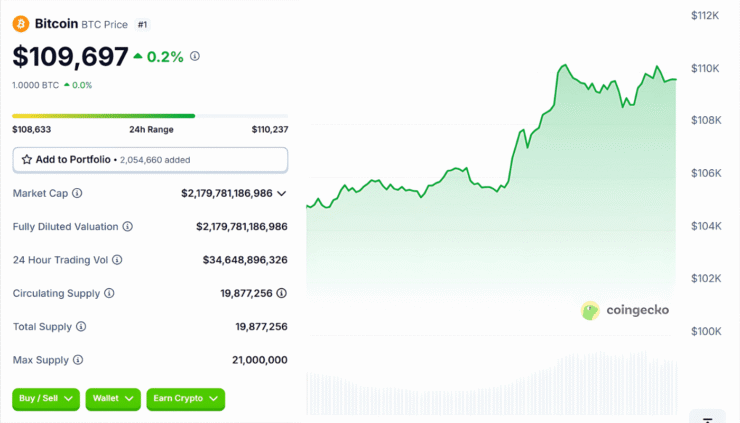

Bitcoin remained steady near the $110,000 level on Tuesday, hovering just below two-week highs as traders awaited a crucial U.S. inflation update. The cryptocurrency touched an intraday high of $110,237 before slipping slightly to around $109,700—up 4.2% over the past week, according to CoinGecko.

The holding pattern reflects cautious optimism as investors weigh continued institutional inflows against broader macroeconomic risks. With Wednesday’s Consumer Price Index (CPI) data likely to sway the Federal Reserve’s policy tone, Bitcoin’s tight range suggests markets are bracing for volatility but have not lost confidence.

Economists expect a 0.2% month-over-month increase in headline CPI and a 0.3% rise in the core index, with year-over-year inflation projected at 2.4%. A hotter-than-expected reading could diminish hopes for rate cuts, while a cooler print may drive renewed momentum into risk assets like crypto.

As of Tuesday, Fed futures data via the CME FedWatch Tool shows markets pricing in a 61% chance of a rate cut in September—highlighting the delicate balance between investor anticipation and economic indicators.

Institutions Keep Accumulating Bitcoin

Despite macro headwinds, institutional interest in Bitcoin remains strong. Strategy, formerly MicroStrategy, has expanded its holdings to 582,000 BTC—further solidifying its status as Bitcoin’s most aggressive corporate backer.

Japan’s Metaplanet has also joined the treasury BTC movement, announcing a $5.4 billion capital raise aimed at increasing its Bitcoin reserves. Similarly, The Blockchain Group has unveiled plans to raise $342 million, underlining a global trend of institutions turning to BTC as a balance sheet asset.

ETF demand continues to surge. BlackRock’s iShares Bitcoin Trust (IBIT) now boasts $70 billion in assets under management, reflecting sustained interest in regulated crypto exposure. Meanwhile, Ethereum ETFs have logged 15 consecutive days of net inflows totaling $837.5 million, according to CoinGlass.

Global Signals Strengthen the Bullish Case

Macro and geopolitical developments are adding to the upbeat crypto sentiment. The U.S. and China are renewing trade negotiations, the UK has reversed its ban on crypto ETFs, and Hong Kong is advancing central bank digital currency pilots in partnership with Chainlink.

Analysts see these signals as proof of a maturing market cycle. Some are even calling this phase a “supercycle”—a term used to describe structurally strong bull markets with sustained capital flows, lighter corrections, and robust institutional foundations.

However, risks remain. If the Federal Reserve suggests delaying interest rate cuts or if risk-asset profit-taking intensifies, crypto markets may retreat as capital shifts back into bonds and other traditional safe havens.

Still, sentiment is largely bullish. Forecasts from firms like Bitwise and VanEck suggest that Bitcoin could reach between $180,000 and $200,000 by year’s end—provided macro conditions remain favorable and institutional inflows persist.

Quick Facts

- Bitcoin steadied near $110K ahead of key CPI and Fed announcements.

- Traders are bracing for macro signals that could impact rate policy and risk sentiment.

- A cooler inflation print may reignite bullish momentum in crypto markets.

- Institutional flows and ETF activity continue to reflect caution across the sector.