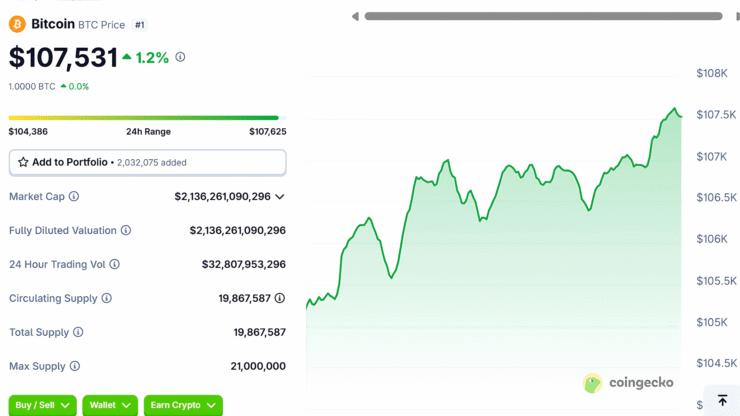

Bitcoin has surged to $107,500, marking its highest price since January and putting the asset within 2% of its all-time high of $108,786—set earlier this year on the day of President Donald Trump’s inauguration.

Market data from CoinGecko confirms that Bitcoin is trading above $107,000, solidifying a full recovery from its April low below $75,000. That decline was largely attributed to fears surrounding escalating global tariffs tied to Trump’s renewed trade agenda.

In recent weeks, however, the narrative has flipped. President Trump has hinted at upcoming trade deals and a potential easing of tariff policy—moves that have sparked renewed optimism across financial markets and reignited appetite for risk-on assets like Bitcoin.

The rally is being fueled by a combination of improving macro sentiment, renewed ETF inflows, and signs of regulatory clarity in Washington. As Bitcoin approaches record levels again, investors are watching closely to see if the momentum will carry it into uncharted territory.

Altcoins Rally While Liquidations Spike on Bitcoin Surge

The cooling of global trade tensions has triggered a wave of bullish momentum across the crypto market. With Bitcoin climbing to $107,000, major altcoins have posted strong gains, riding the wave of renewed investor confidence.

Ethereum has led the altcoin recovery, rising 58% over the past 30 days. Dogecoin has gained 45%, while Solana is up nearly 23%. Even meme coins—many of which had faded in 2024—have made explosive comebacks, driven by speculative trading activity and social buzz.

But the rally has come with significant volatility. Data from CoinGlass shows that more than $233 million in crypto positions were liquidated over the past 24 hours. Short sellers accounted for more than half of those losses, as rising prices invalidated bearish bets.

Ethereum saw the most liquidations during this period, with $69 million in positions closed out—primarily from over-leveraged long trades. The sudden volatility has put traders on high alert, navigating between breakout potential and correction risk in real time.

Quick Facts

- Bitcoin has surged to $107,000, just 2% below its all-time high of $108,786, last reached in January.

- The rally is fueled by softening U.S. trade rhetoric, renewed ETF inflows, and regulatory optimism.

- Altcoins like Ethereum (+58%), Dogecoin (+45%), and Solana (+23%) have also posted strong gains.

- Over $233 million in liquidations occurred in 24 hours, with Ethereum seeing the largest share.