Bitcoin treasury giant Strategy Inc. has made another major move in the crypto markets, adding 22,048 BTC to its reserves between March 24 and March 30. The purchase, valued at approximately $1.92 billion, was disclosed in a recent 8-K filing with the U.S. Securities and Exchange Commission—further cementing the company’s position as one of the largest corporate holders of Bitcoin.

The average price of the latest acquisition was $86,969 per BTC, marking another bold move in the firm’s aggressive long-term accumulation strategy.

The company now owns a staggering 528,185 BTC, valued at over $43 billion at current prices. The total acquisition cost stands at around $35.63 billion, or an average of $67,458 per BTC, including fees and expenses.

That puts over 2.5% of Bitcoin’s maximum 21 million supply under Strategy’s control, further cementing its position as the single largest publicly held Bitcoin treasury.

“This is a strategic reserve of monetary energy,” said co-founder and executive chairman Michael Saylor, reiterating the firm’s long-held belief in Bitcoin as a superior store of value.

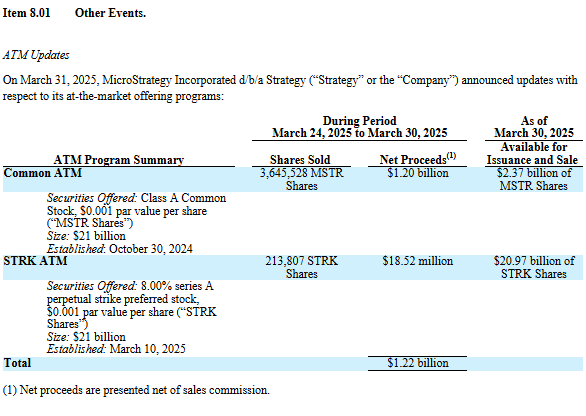

The recent purchases were funded through a combination of equity sales:

- 3.65 million MSTR shares sold for approximately $1.2 billion

- 213,807 STRK shares sold for roughly $18.5 million

According to the filing, as of March 30, the company still has $2.37 billion worth of MSTR shares and $20.97 billion worth of STRK shares available for future issuance.

These offerings are part of the firm’s larger “21/21 Plan,” targeting a $42 billion capital raise across equity and fixed-income instruments to acquire Bitcoin.

GameStop Follows Suit as Bitcoin Goes Corporate

Strategy’s accumulation appears to be influencing others. On Tuesday, GameStop—the video game retailer and meme stock icon, announced plans to adopt a similar corporate Bitcoin strategy. The company unveiled a $1.3 billion convertible note offering, marking its first steps toward BTC balance sheet exposure.

This follows a growing list of public companies warming up to the idea of holding Bitcoin as a treasury asset, spurred in part by Strategy’s lead.

Despite its enormous BTC holdings, Strategy trades at a significant premium to its net asset value (NAV), with a market capitalization of $75.4 billion. Some investors have voiced skepticism over this premium and the company’s ongoing issuance of shares to fund acquisitions.

Still, analysts at Bernstein maintain a bullish outlook. They argue that with debt under 13% and no repayments due until 2028, the firm’s leverage remains “highly manageable.”

The brokerage also recently predicted that Strategy could eventually hold over 1 million BTC if Bitcoin reaches its estimated $1 million price target by 2033.

The Takeaway

With over half a million BTC and a roadmap for more, Strategy continues to redefine corporate treasury management. Whether the market favors or punishes this aggressive strategy in the short term, it’s clear the company is playing the long game—one Bitcoin at a time.