Bitcoin is showing renewed strength as its price flirts with a major resistance zone near $107,000, while on-chain activity pushes transaction fees to their highest levels of 2025. The uptick in both metrics signals a spike in demand for Bitcoin’s network, with users willing to pay more to confirm transactions as competition for blockspace intensifies.

On Sunday, Bitcoin briefly tapped $107,000—just above its prior May 12 high of $105,600—before pulling back slightly to trade around $103,500 at press time. The price action reflects ongoing bullish momentum as the market continues to test upper limits set earlier in the year.

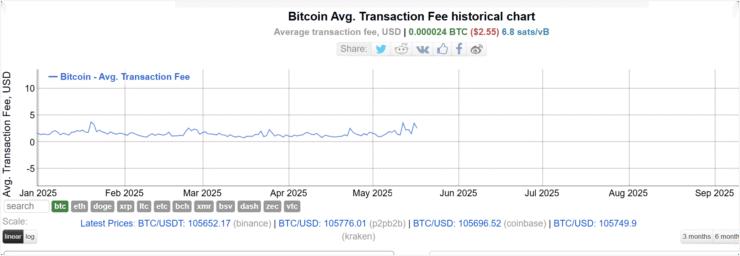

Accompanying the price rally is a noticeable rise in average transaction fees. According to data from InfoCharts, the seven-day moving average for BTC fees has climbed to $2.40, the highest mark of the year so far and up nearly $1 since the start of May. This increase underscores the pressure building on the Bitcoin network during times of high trading activity.

At the same time, Bitcoin’s market dominance has begun ticking upward again after a brief pullback earlier this month. Analysts suggest the previous dip was likely a temporary liquidity shift rather than a meaningful pivot toward altcoins—putting to rest talk of an imminent “altcoin season.”

The growing demand for Bitcoin blockspace and fee pressure also reignites discussion about scalability, particularly in times of market volatility. As Bitcoin inches toward retesting all-time highs, addressing these efficiency challenges could be vital in ensuring the rally isn’t hampered by usability constraints.

Lower Activity, Higher Fees Hint at Supply Squeeze

While Bitcoin transaction fees are climbing to yearly highs, the volume of daily transactions on the network is surprisingly dropping—a counterintuitive trend that hints at deeper structural shifts beneath the surface.

According to recent data, average daily transactions on the Bitcoin network have fallen by 35% since April 22, dropping from over 507,000 to just 330,000. This decline in activity contrasts sharply with rising fees, suggesting that the current network congestion isn’t due to sheer transaction volume but rather increased competition for limited blockspace—often driven by high-value transfers or complex transactions.

At the same time, Bitcoin’s illiquid supply—the portion of BTC held in wallets with little or no recent spending history—has reached a new all-time high, per data from Glassnode. This indicates that more holders are locking away their coins rather than selling, reducing the amount of BTC readily available on exchanges.

Such conditions set the stage for a classic supply squeeze. If demand surges while available supply continues to shrink, the market could be primed for a significant upward move. With fewer coins circulating and more investors opting to hold, even modest buying pressure could spark another leg up for BTC’s price.

Moreover, the recent Bitcoin halving event, which reduced miner rewards, places additional emphasis on transaction fees as a source of income for miners. This shift could incentivize the development and adoption of solutions that enhance network efficiency and reduce costs for users.

Quick Facts

- Bitcoin briefly touched $107K before settling near $103.5K

- BTC transaction fees hit a 2025 high of $2.40

- Daily Bitcoin transactions dropped 35% since April

- Illiquid supply reaches all-time high, indicating strong holding behavior

- Analysts expect rising demand and reduced supply to fuel further gains