Bitcoin edged lower on Thursday after fresh U.S. inflation data showed a sharper-than-expected drop in wholesale prices, raising questions about the Federal Reserve’s next policy move.

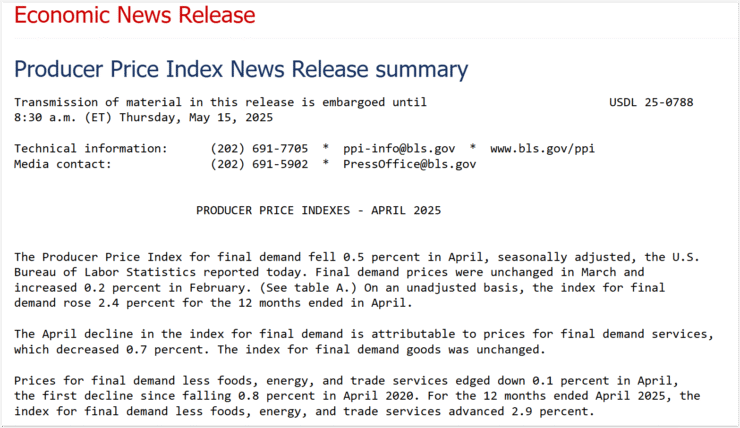

According to the Bureau of Labor Statistics, the Producer Price Index (PPI) fell by 0.5% in April, in contrast to economists’ forecasts of a modest 0.2% increase. On a year-over-year basis, the index rose 2.4%, slightly cooler than projections. The core PPI—excluding food, energy, and trade—also dipped by 0.1%, marking its first decline since the pandemic onset in April 2020.

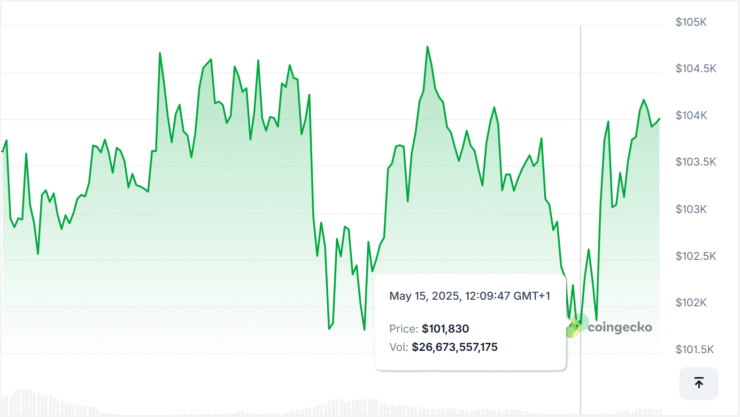

Markets responded quickly. Bitcoin fell 1.3% to around $102,655, according to CoinGecko, reversing earlier gains. Ethereum dropped 2.2%, while Solana and Avalanche followed with losses of 1.7% and 2.1%, respectively.

Meanwhile, meme coins like Dogecoin and Shiba Inu hovered around flat, continuing to trade in narrow ranges after showing limited movement earlier in the week in response to Tuesday’s consumer inflation report.

The PPI release has added to speculation that disinflation could open the door for potential rate adjustments later this year, although the Fed remains cautious. Investors are now awaiting more decisive data, including the upcoming PCE index, to better gauge the central bank’s trajectory.

Services Lead Drop as PPI Posts Surprise Decline

April’s unexpected drop in U.S. wholesale inflation came largely from the services sector, but analysts say it may not be enough to sway crypto markets—at least not on its own.

The Producer Price Index (PPI), a key inflation measure that tracks what domestic suppliers charge wholesalers and retailers, fell 0.5% last month, according to the Bureau of Labor Statistics. That decline was driven entirely by a 0.7% drop in services—the steepest monthly slide in the category since tracking began in 2009.

More than two-thirds of that drop came from narrowing profit margins in final demand trade services, particularly within machinery and vehicle wholesaling, which saw a dramatic 6.1% decline.

Despite the sharp move, market response has been relatively restrained. According to Aurélie Barthere, Principal Research Analyst at Nansen, the data didn’t carry the weight to meaningfully shift sentiment.

“I don’t view the PPI as a significant catalyst for Bitcoin in the current environment,” she noted, adding that only a “meaningful upside surprise” could have altered expectations for Fed rate policy.

Instead, all eyes were turned to Federal Reserve Chair Jerome Powell, who had a scheduled speech later in the day.

Powell Signals Messaging Shift, Reaffirms 2% Inflation Goal

Shortly after the latest inflation data hit the wires, Federal Reserve Chair Jerome Powell reaffirmed the central bank’s commitment to its 2% inflation target—but acknowledged that the Fed may soon revise how it communicates policy expectations, especially during periods of heightened economic volatility.

Speaking Thursday, Powell indicated that updates to the Fed’s consensus statement could be introduced “in the coming months,” with specific changes possibly addressing how the central bank discusses economic shortfalls, projections, and uncertainty.

“As we have been reviewing assessment of the 2020 and of policy decisions in recent years, a common observation is the need for clear communications as complex events unfold,” Powell said.

“A critical question is how to foster a broader understanding of the uncertainty that the economy generally faces in periods of larger, more frequent, or more disparate shocks.”

The comments came amid a week of cautious optimism in markets. Earlier, investor sentiment had improved after the U.S. and China agreed to pause retaliatory tariffs for 90 days. Tuesday’s Consumer Price Index (CPI) data also provided some relief, showing a 0.2% month-over-month increase and 2.3% annual rise—both aligned with expectations and seen as a sign that inflation remains under control.

Still, Powell’s remarks suggest the Fed is actively reevaluating its messaging strategy to better guide market expectations through what remains an uncertain and data-sensitive landscape.

Quick Facts

- Bitcoin dropped 1.3% to around $102,655 after U.S. PPI data showed an unexpected 0.5% decline in April, driven mainly by falling services prices.

- The core PPI, which excludes food, energy, and trade, also fell 0.1%, marking its first decline since April 2020.

- Ethereum, Solana, and Avalanche all posted 1.7–2.2% losses, while meme coins traded flat.

- Jerome Powell reaffirmed the Fed’s 2% inflation target but hinted at upcoming changes in how the central bank communicates policy during volatile periods.