Bitcoin (BTC) is heading for its worst month in nearly three years, tumbling 22% in February amid growing macroeconomic concerns. The downturn follows President Donald Trump’s new tariff policies, which have fueled fears of rising inflation, reduced the likelihood of interest rate cuts, and dampened investor appetite for risk assets, including cryptocurrencies.

The decline marks Bitcoin’s steepest monthly drop since June 2022, when it plummeted by over a third. This week alone, BTC has slid nearly 18%, making it the worst-performing week since November 2022.

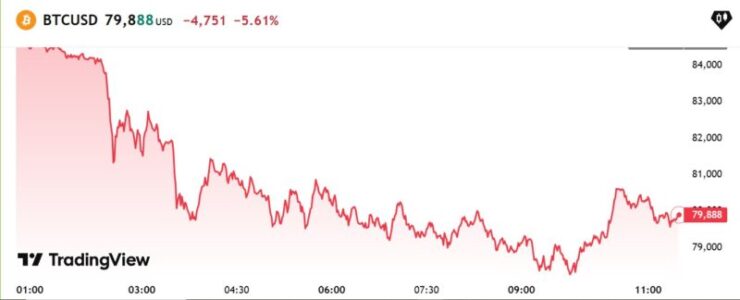

At its lowest point on Friday, Bitcoin briefly dipped below $80,000, erasing a significant portion of its year-to-date gains. Investors who bought BTC at the 2025 average purchase price of $97,880 are now facing unrealized losses of over 18%, highlighting the severity of the recent sell-off.

Crypto Market Wipe-out, a Familiar Trend

While Bitcoin’s steep decline has left many investors in the red, historical trends suggest that unrealized losses early in the year are not uncommon. In past cycles, Bitcoin has often traded below its cost basis at the start of the year before rebounding later. However, the scale of the current downturn has intensified concerns.

On-chain data shows that realized losses have surged as Bitcoin’s price plummeted. In the past three days alone, the market has recorded approximately $1 billion in realized losses per day, marking the most significant loss streak since August 2024, when the yen carry trade unwind sent BTC tumbling to $49,000.

Beyond Bitcoin, the broader cryptocurrency market has been hit hard. A staggering $1.1 trillion has been wiped from the total crypto market cap, bringing it down to $2.59 trillion, according to TradingView data. Major altcoins like Ethereum (ETH), Solana (SOL), and XRP have also suffered sharp declines, mirroring Bitcoin’s downward trajectory.

Factors Contributing to the Decline

Several elements have contributed to this downturn:

- Macroeconomic Concerns: President Donald Trump’s proposed tariffs on major U.S. trading partners have raised fears of accelerated inflation and diminished prospects for interest rate cuts, leading to reduced risk appetite among investors.

- Market Sentiment Shift: The initial optimism following the election of a pro-crypto administration has waned, as concrete regulatory frameworks and supportive policies have yet to materialize, even though there are good signs.

- Security Breaches: A significant $1.5 billion hack of the Bybit exchange has undermined confidence in the security of digital asset platforms, contributing to the sell-off.

Quick Facts:

- Bitcoin has fallen 22% in February, the most significant drop since June 2022.

- This week, Bitcoin’s value decreased by nearly 18%, marking the worst week since November 2022.

- The average Bitcoin purchase price in 2025 is $97,880, resulting in over 18% unrealized losses at current prices.

- The decline is attributed to macroeconomic concerns, fading pro-crypto sentiment, and significant security breaches in the crypto space.