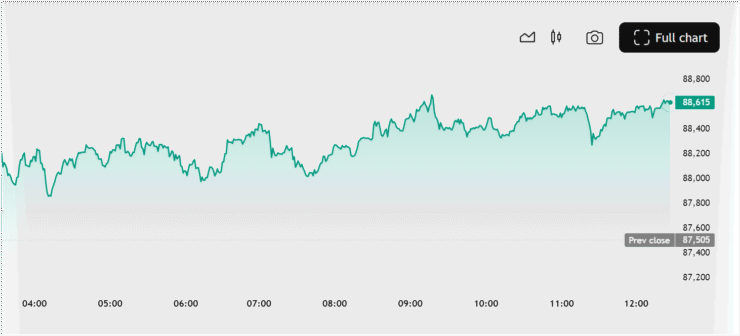

Bitcoin’s rally to a four-week high near $89,000 stalled on April 22, sparking fresh warnings of a possible 10%–15% correction as key technical signals turned bearish. According to TradingView data, BTC/USD retreated sharply after hitting $88,874, failing to break decisively above the 200-day simple moving average (SMA)—a historically significant resistance level.

The pullback came as gold extended its record-breaking run, adding pressure on Bitcoin bulls who were hoping for a similar breakout. While Bitcoin briefly climbed above its exponential moving average (EMA) earlier in the session, the rejection at the 200-day SMA left the asset in a vulnerable technical position.

Prominent trader Daan Crypto Trades highlighted $85,000 as a short-term support level, cautioning that further downside could follow if BTC fails to hold above it.

“Fun won’t start until we get some daily closes back above the previous range low at ~$90K. Important to hold ~$85K below I’d say.” he posted on X.

This rejection echoes similar patterns observed during past overbought conditions, particularly with the stochastic RSI now flashing cooldown signals. Analysts are closely watching whether Bitcoin can stabilize—or if a deeper correction looms.

Analysts Divided: Reversal or Deeper Pullback?

The rejection at $89,000 has reopened debate among traders over whether Bitcoin is staging a real recovery or simply setting up for another leg down.

The 200-day SMA, once a reliable support during previous bull cycles, flipped into resistance in March following rising U.S. trade tensions. After dropping to five-month lows below $75,000, Bitcoin rebounded into its current range—but the rally is now meeting renewed headwinds.

Trader Roman pointed to the stochastic RSI once again entering “overbought” territory, warning that past occurrences led to 10–15% corrections.

“The last 4 times stoch RSI has been overbought, we’ve seen a 10-15% correction,” he noted, adding that the S&P 500’s ongoing weakness may further pressure crypto markets.

Not all traders agree. Analyst Cas Abbe pushed back against the correction narrative, citing signs of a market bottom and rising whale accumulation. He also pointed to the Coinbase premium and improving on-chain metrics as signs that the rally is still intact.

“I believe that $74K-$75K zone was the bottom for $BTC. Most alts have also bottomed out and we could see a sustained rally,” Abbe argued in a detailed X thread.

With macro uncertainty, institutional flows, and technical divergence all in play, Bitcoin now stands at a critical crossroads—poised for either renewed upside or a broader correction.

Quick Facts

- Bitcoin faced resistance near $89,000, raising correction risks of 10%–15%.

- The 200-day SMA and stochastic RSI are flashing key warning signals.

- Macro uncertainty and equity market weakness are adding pressure.

- Gold’s continued rally contrasts with Bitcoin’s latest rejection.