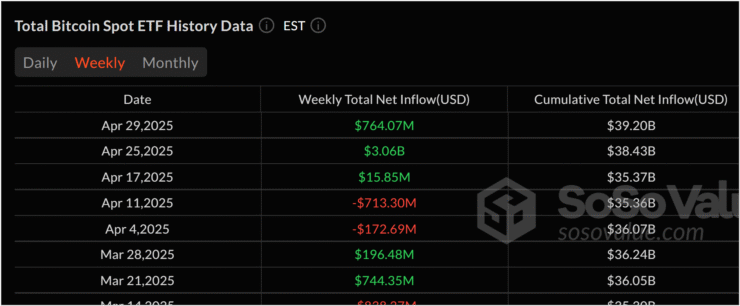

Bitcoin exchange-traded funds (ETFs) listed in the U.S. recorded over $3 billion in net inflows in the five trading days of last week, while gold ETFs saw $1 billion in outflows—marking a striking $4 billion divergence. According to analysts, it’s the largest shift in flows between the two assets since the November 2024 U.S. presidential election, signaling evolving investor preferences amid macroeconomic uncertainty.

The surge in Bitcoin ETF demand suggests a growing belief that Bitcoin offers better protection against U.S.-centric financial risks than gold. Analysts at Standard Chartered, led by Geoffrey Kendrick, attributed the shift to rising U.S. Treasury yields and falling interest in long-dated government bonds.

“Bitcoin is increasingly being seen as a more effective hedge than gold against strategic asset reallocation out of the U.S.,” Kendrick wrote in a recent client note.

The data backs it up. As of December 2024, U.S.-based spot and derivatives Bitcoin ETFs now hold over $129 billion in combined assets under management (AUM), surpassing gold ETFs for the first time ever. The milestone reflects a broader move by institutions to treat Bitcoin as a legitimate macro hedge, not just a speculative play.

Still, gold remains relevant. Prices have continued to rise amid persistent inflation concerns, geopolitical instability, and a weaker U.S. dollar—factors that continue to attract long-term capital. However, the contest between gold and Bitcoin as primary hedges is becoming more intense than ever.

Weak Treasury Demand Pushes Flows to Bitcoin

The rotation into Bitcoin may stem from deeper structural shifts, especially as demand for long-term U.S. Treasurys weakens. According to Michael Metcalfe of State Street Markets, foreign interest in 30-year Treasury bonds fell to five-year lows by the end of April.

This declining demand is reshaping global capital allocation, with investors turning toward non-traditional hedges—and Bitcoin is emerging as the clear beneficiary. Kendrick of Standard Chartered noted that while gold has historically served this role, recent progress in global trade relations has slightly undercut its appeal.

As traditional safe havens lose favor, digital alternatives are gaining credibility. The movement underscores a broader willingness by institutions to treat Bitcoin as a hedge in response to macro uncertainty and policy instability.

Trade Thaw Pressures Gold, Bitcoin Demand Persists

Signs of easing tensions between the U.S. and China are beginning to weigh on gold’s recent performance. Reciprocal tariff exemptions have softened the need for traditional safe-haven assets, leading to a short-term decline in gold ETF inflows.

In contrast, Bitcoin’s outlook remains optimistic. Despite a modest 0.3% dip in the past 24 hours (now trading at $94,979), analysts expect continued momentum. Broader macro concerns—particularly over U.S. fiscal stability and policy direction—are keeping digital asset demand high.

Standard Chartered reiterated its bullish stance, forecasting that Bitcoin could reach a new all-time high before quarter-end. The bank maintains its year-end price target of $200,000, expecting the asset to gain steam through the summer months.

Meanwhile, the broader crypto market fell 2%, suggesting a brief pullback in what many still consider a structurally bullish cycle for digital assets.

Quick Facts

- Bitcoin ETFs saw $3B in inflows, while gold ETFs lost $1B in the past five days.

- The $4B gap in flows is the biggest since the November 2024 election.

- Analysts point to rising Treasury yields and falling bond demand as drivers.

- Bitcoin ETF AUM hit $129B in December 2024, overtaking gold ETFs for the first time.