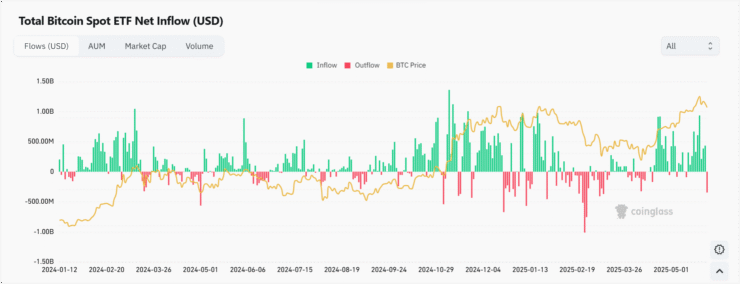

U.S. spot Bitcoin ETFs recorded their first collective net outflow in more than two weeks on May 29, with investors pulling $347 million amid a broader market dip that sent Bitcoin’s price below $105,000. The outflow ended a 10-day inflow streak—last interrupted on May 13—and marked the largest single-day loss since March 11, when funds saw $396 million withdrawn.

The Fidelity Wise Origin Bitcoin Fund (FBTC) led the retreat with a $166 million outflow, while Grayscale’s GBTC followed with $107.5 million withdrawn. Other issuers, including Bitwise, Ark 21Shares, Invesco, Franklin Templeton, and VanEck, all reported significant redemptions.

Meanwhile, CoinShares, WisdomTree, and Grayscale’s mini Bitcoin trust posted zero net flows—suggesting a general pause in investor activity rather than renewed buying pressure.

BlackRock’s IBIT Extends Inflow Streak to 34 Days

Amid a wave of redemptions across the ETF sector, BlackRock’s iShares Bitcoin Trust (IBIT) continued to outperform, bringing in $125 million in fresh capital on May 29. This marked the fund’s 34th consecutive day of inflows, extending a historic streak that began on April 9.

In the last two weeks alone, IBIT has attracted nearly $4 billion in net inflows, pushing its cumulative total to $49 billion. The fund now manages over $70 billion in assets—highlighting its dominance in the spot Bitcoin ETF market.

According to ETF Store President Nate Geraci, the past five weeks have seen over $9 billion flow into Bitcoin ETFs, while gold ETFs lost $3 billion—a shift that reflects growing investor preference for digital alternatives over traditional safe-haven assets.

Ether ETFs Ride 10-Day Inflow Streak

While Bitcoin funds faced redemptions, spot Ether ETFs continued their upward trend. Data from Farside Investors shows $92 million in net inflows on May 29, marking the 10th straight day of positive flow—Ether ETFs’ longest streak since mid-May.

Leading the surge was BlackRock’s iShares Ethereum Trust (ETHA), which took in $50 million during the day. Since launching in July 2024, ETHA has attracted about $4.5 billion in net inflows, reflecting strong institutional appetite for Ethereum’s programmable capabilities.

The continued interest follows SEC guidance issued earlier this week clarifying that protocol staking—where tokens are used to secure blockchain consensus—does not qualify as a securities activity. Nate Geraci called the development “another hurdle cleared for staking in spot ETH ETFs,” further strengthening the investment case for regulated Ethereum products.

Quick Facts

- Bitcoin ETFs saw $347 million in outflows on May 29—their largest daily pullback since March.

- Fidelity’s FBTC and Grayscale’s GBTC led the redemptions, while smaller issuers also reported losses.

- BlackRock’s IBIT defied the trend with $125 million in inflows, marking its 34th straight day of gains.

- Ether ETFs recorded 10 straight days of inflows, boosted by new SEC staking guidance.