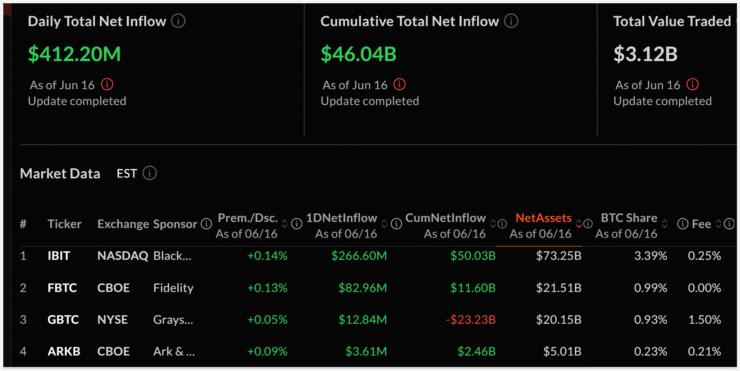

Institutional appetite for Bitcoin remains strong despite mounting geopolitical tensions. On Monday, U.S.-listed spot Bitcoin ETFs recorded a combined $412.2 million in net inflows, marking the sixth consecutive day of positive capital movement. The streak, which began on June 9, has now amassed over $1.8 billion in new investments—even as the conflict between Iran and Israel intensifies.

According to data from SoSoValue, inflows during this streak have remained robust, with peaks of $431.1 million on June 10 and $322.6 million on June 14. The latest $412 million injection reinforces that institutional investors are undeterred by global unrest, viewing volatility as a buying opportunity rather than a threat.

With this surge, total net assets across all U.S. spot Bitcoin ETFs have risen to $132.5 billion, now representing more than 6.1% of Bitcoin’s total market capitalization. Trading volumes also remain elevated, with over $3.1 billion in ETF shares exchanged on Monday—clear evidence that capital markets continue to engage deeply with crypto amid global uncertainty.

BlackRock’s IBIT Dominates Bitcoin ETF Inflows Amid Geopolitical Tensions

Leading the latest round of inflows was BlackRock’s iShares Bitcoin Trust (IBIT), which posted a standout $266.6 million in net inflows on Monday. The move pushes IBIT’s assets under management past the $50 billion mark, solidifying its position as the institutional benchmark for Bitcoin exposure.

Fidelity’s FBTC followed with a strong $82.9 million inflow, while Grayscale’s GBTC brought in $12.8 million. Despite taking part in the broader upswing, GBTC continues to carry cumulative net outflows of over $23 billion since its conversion to an ETF—reflecting a persistent shift in investor preference toward lower-fee, more liquid offerings.

Commenting on the trend, Vincent Liu, CIO at Taiwan-based Kronos Research, emphasized the long-term thinking driving the activity.

“Steady Bitcoin ETF inflows reflect growing trust in BTC’s resilience, accessibility, and role as a hedge in a shifting macro environment,” Liu told reporters.

Bitcoin Sheds 7% After Geopolitical Flare-Up, But Support Zone Holds

Bitcoin ended last week with a sharp pullback after a surprise Israeli strike on Iran triggered widespread market jitters. The digital asset dropped more than 7% in a single session, erasing earlier gains and testing the $102,000 support level.

However, on-chain data suggests the drop was largely emotional. A Monday report from Bitfinex highlighted a sharp decline in Net Taker Volume—a measure of aggressive market participation—down to a multi-week low of $197 million. The drop hints at panic selling, consistent with past capitulation events.

A surge in liquidations across futures markets also underscored the emotional nature of the sell-off. Bitfinex analysts argue that as long as Bitcoin can maintain the $102,000–$103,000 support zone, the market structure remains intact. This level could even serve as the foundation for a rebound.

Historically, sharp sell-offs driven by geopolitical shocks have often been followed by local market bottoms, especially when internal fundamentals remain strong. With ETF inflows holding steady and institutional interest intact, traders are now eyeing a potential bounce from current levels.

Quick Facts

- U.S. spot Bitcoin ETFs posted $412.2 million in net inflows on Monday, marking six straight days of gains totaling over $1.8 billion.

- BlackRock’s IBIT led inflows with $266.6 million, pushing its AUM above $50 billion, followed by Fidelity’s FBTC at $82.9 million.

- Despite geopolitical tensions, total assets in U.S. Bitcoin ETFs have climbed to $132.5 billion, representing over 6.1% of BTC’s market cap.

- Bitcoin dropped 7% last week following an Israeli strike on Iran, but analysts say the move was emotional, with key support levels still holding firm.