Bitcoin extended its losses over the weekend, hitting a three-week low amid intensifying macroeconomic pressures and renewed fears of a global trade war. As of Sunday evening, the asset had dropped more than 7.7% over a 24-hour period, falling to $77,000, according to data from CoinGecko.

The downturn coincided with sharp moves in U.S. equity futures, which began the week in negative territory. Futures tied to the S&P 500 slid 4.3%, while Dow and Nasdaq 100 futures fell 4% and 4.6%, respectively, during early Asian trading hours—signaling broad-based risk-off sentiment heading into the week.

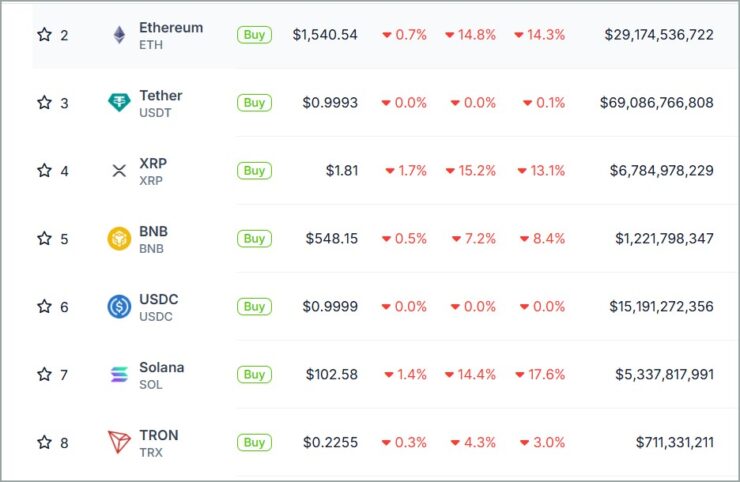

Ethereum suffered an even steeper correction, tumbling nearly 12% to $1,575, while other altcoins followed suit—dragged down by the same macroeconomic headwinds affecting traditional markets. With investors bracing for further volatility, the crypto sell-off mirrored the sharp pullback seen across global equities as traders reacted to new tariff threats and mounting geopolitical uncertainty.

Trump Tariffs Spark Global Jitters

The latest leg of the crypto downturn appears to have been triggered by President Donald Trump’s aggressive new tariff policy, which officially took effect on Saturday. The sweeping measures include a blanket 10% levy on nearly all imports, along with steeper country-specific tariffs aimed at major U.S. trading partners—part of a broader “reciprocal” trade doctrine that has reignited fears of a prolonged global trade conflict.

Under the new rules, imports from China now face a 34% tariff, while goods from the European Union are subject to a 20% duty. The administration argues that these rates are designed to mirror the trade restrictions these countries impose on U.S. exports.

The reaction from global markets was swift. As CME futures opened Sunday evening, equities dropped sharply—and cryptocurrencies soon followed.

Traders Braced for Turbulence as Wall Street Reacted Early

Market tensions were already building well before the U.S. trading week began. According to Peter Chung, head of research at Singapore-based crypto trading firm Presto, major institutional desks were on alert in the early hours of Monday Asia time.

“There was chatter that Wall Street banks called their traders back to their desks before 5 a.m. HKT this morning ahead of CME futures opening,” Chung told Decrypt.

“Tension was in the air for something big to go down.”

While the sell-off has shaken markets, Chung suggested that the volatility might not last. He pointed to potential developments in Washington that could quickly shift sentiment.

“There’s been chatter that not everyone in the White House is on board with the pace of the tariff implementations,” he noted.

“If Trump backs down, or the Fed responds with dovish comments or hints at emergency intervention, things could quickly turn around.”

As Bitcoin and the broader crypto market continue to react to shifting global dynamics, investors are closely watching the intersection of monetary policy and geopolitics.

Quick Facts

- Bitcoin fell over 6% in 24 hours, dropping to $77,700—its lowest level in three weeks.

- Ethereum declined nearly 12%, with altcoins seeing similar losses across the board.

- The crypto downturn mirrored sharp drops in U.S. equity futures, including a 4.3% fall in the S&P 500.

- Escalating global trade tensions and new tariffs have triggered a broader risk-off environment across markets.