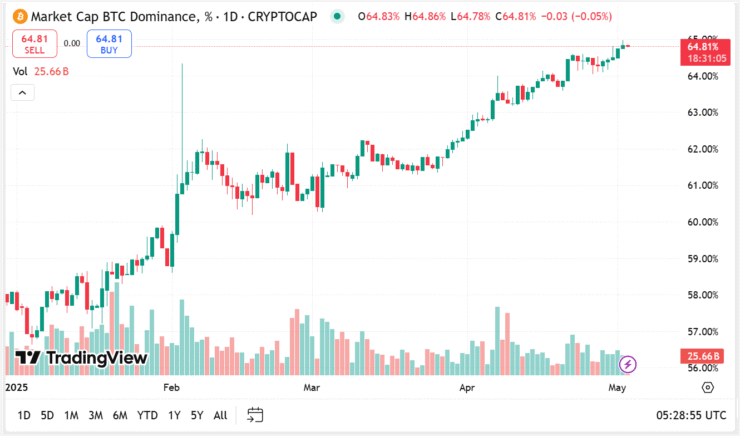

Bitcoin has reasserted its dominance over the broader crypto market, climbing to a four-year high of 64.8% in total market share, according to data from TradingView. This surge in dominance coincides with BTC crossing the $97,000 mark on Friday morning, inching closer to the much-anticipated $100K milestone.

The increase represents a sharp rebound from earlier dips in dominance, particularly in late 2024, when post-election altcoin rallies briefly narrowed the gap. At the start of 2025, Bitcoin’s market dominance stood at roughly 57.9% before recovering rapidly amid investor anxiety tied to rising U.S. tariffs and global macro uncertainties.

Analysts point to Bitcoin’s resilience as a store of value during turbulent economic periods as a key reason for this shift. While altcoins enjoyed a wave of speculative inflows after Trump’s electoral victory, the return of geopolitical risks and regulatory overhang quickly flipped investor sentiment, prompting a flight to perceived safety in Bitcoin.

The renewed dominance also signals a broader trend of consolidation in the digital asset space, with BTC reclaiming its reputation as crypto’s flagship asset while many alternative tokens struggle to maintain momentum.

Bitcoin Outpaces Rivals on Tariff Relief Tailwinds

Despite being initially rattled by the fallout from sweeping trade tariffs, Bitcoin has staged a strong recovery in recent weeks—thanks in part to policy softening by the Trump administration. Exemptions and adjustments to tariff measures appear to have reignited investor confidence in Bitcoin, even as the broader altcoin market struggles to regain footing.

On Friday, BTC climbed to $97,000—just 10.9% shy of its record high of $108,786 reached in January. This rally highlights Bitcoin’s relative strength, especially when compared to top altcoins that remain significantly off their peaks. According to CoinGecko data, Ethereum is down 54% from its highs, while Solana and Dogecoin are lagging by 43% and 61%, respectively.

As of publication, Bitcoin has slightly cooled to $96,947, though it remains up 0.7% for the day. The divergence in performance underscores Bitcoin’s increasingly distinct status as a macro-resilient digital asset—particularly in a market still grappling with regulatory uncertainty and shifting geopolitical dynamics.

Flight From U.S. Assets Boosts Bitcoin Appeal

Bitcoin’s recent surge has been amplified by a broader shift in capital away from traditional U.S. assets. Amid ongoing geopolitical tensions and economic uncertainty, investors have increasingly favored Bitcoin over instruments like U.S. Treasuries and even gold. This week alone, Bitcoin ETF inflows outpaced gold ETFs by a striking $4 billion, signaling a deepening preference for digital hedges.

However, the tide could turn if the U.S. successfully navigates a new round of trade negotiations. The Trump administration has signaled an openness to talks with China, with reports indicating that Beijing is currently weighing a proposal for renewed engagement. A breakthrough deal—or even a de-escalation in trade rhetoric—could improve macroeconomic sentiment globally.

If that happens, capital might flow back into traditional markets and riskier altcoins, potentially softening Bitcoin’s dominance and shifting momentum within the crypto space once again. For now, though, Bitcoin remains the market’s favored safe haven.

Quick Facts

- Bitcoin dominance has surged to 64.89%, its highest level since January 2021.

- The BTC price topped $97,000, driven by investor flight from altcoins and U.S. assets.

- Bitcoin ETF inflows outpaced gold ETFs by $4 billion this week.

- Geopolitical tensions and regulatory uncertainty continue to steer capital into BTC as a safer crypto hedge.