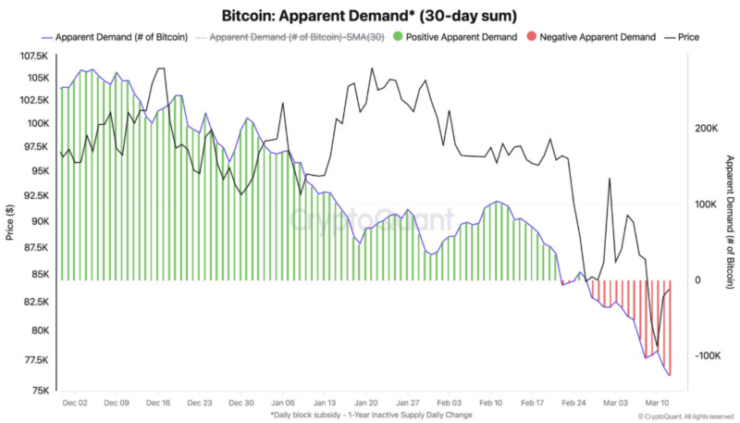

Apparent demand for Bitcoin (BTC) has reached its lowest point in 2025, entering negative territory as traders and investors adopt a cautious stance toward risk-on assets due to prevailing macroeconomic uncertainties.

According to CryptoQuant’s Bitcoin Apparent Demand metric, demand for Bitcoin dropped to negative 142 on March 13. This metric had remained positive since September 2024, peaking around December 2024, before gradually declining and turning negative in early March 2025.

Post-Election Market Euphoria Fades as Bitcoin Struggles

Following weeks of post-election optimism, Bitcoin’s market momentum has cooled significantly, weighed down by macroeconomic uncertainty and shifting investor sentiment.

The March 7 White House Crypto Summit initially sparked enthusiasm among crypto supporters but has failed to sustain positive market sentiment as investors react to broader financial concerns.

Despite the March 12 Consumer Price Index (CPI) inflation report showing lower-than-expected figures, Bitcoin’s price dropped immediately after the news, indicating that macroeconomic headwinds continue to overpower bullish narratives.

Investors remain cautious as uncertainties surrounding interest rates, recession risks, and financial regulations cloud the outlook for high-risk assets like cryptocurrencies.

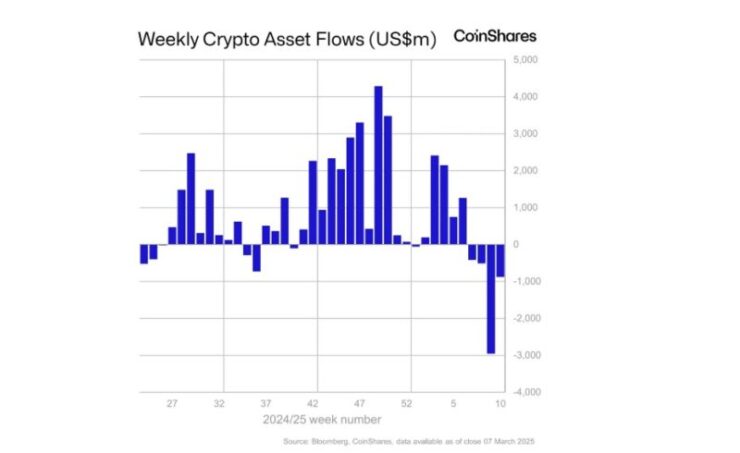

ETF Outflows and Capital Flight Intensify Market Pressures

One of the most telling signs of weakening demand for Bitcoin is the four consecutive weeks of outflows from crypto exchange-traded funds (ETFs). Since February 2025, institutional investors have been reducing their exposure to Bitcoin-related investment vehicles, opting for safer assets amid growing economic fears.

According to CoinShares, crypto ETFs have seen a staggering $4.75 billion in outflows over the past four weeks, with Bitcoin investment funds losing $756 million month-to-date. This exodus of institutional capital has contributed to heightened volatility and downward price pressure, further eroding confidence in the crypto market.

“Digital asset investment products saw their 4th consecutive week of outflows, totalling US$876m. Although this indicates a slowdown in the pace of outflows, investor sentiment remains bearish. The cumulative outflows over this period now amount to US$4.75bn, reducing the year-to-date inflows to US$2.6bn,” The report states.

Crypto Market Cap Shrinks as Bearish Sentiment Spreads

The broader crypto market has also suffered heavy losses in the wake of Bitcoin’s downturn. Since Trump’s inauguration on January 20, the Total3 Market Cap—a measure of the total cryptocurrency market capitalization excluding Bitcoin and Ethereum—has plunged by more than 27%, dropping from over $1.1 trillion to approximately $795 billion.

This decline reflects a widespread pullback from altcoins, as investors rotate away from high-risk assets amid ongoing fears of a potential global recession. The panic selling triggered by poor market sentiment has led to sharp declines across multiple crypto sectors, with smaller-cap assets experiencing even more severe losses.

Quick Facts:

- Bitcoin’s apparent demand turned negative in March 2025, reaching a low of -142 on March 13.

- Price Movement: Bitcoin’s price declined from over $109,000 in January to approximately $83,500 by mid March.

- Crypto ETFs experienced $4.75 billion in outflows over four weeks starting in February 2025.

- The total crypto market cap, excluding Bitcoin and Ether, fell by over 27% since January 20, 2025.