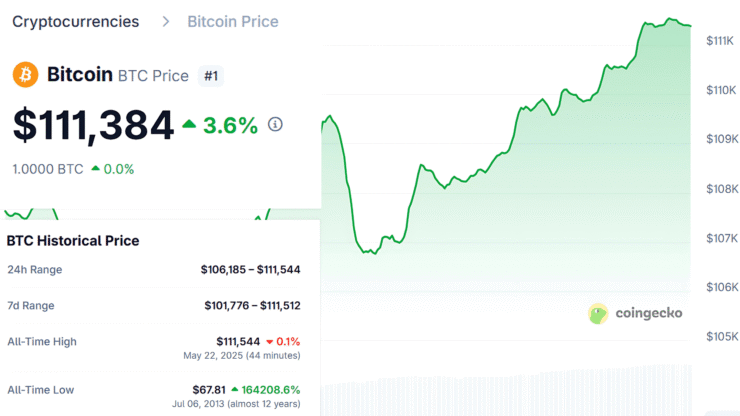

Bitcoin surged to a new all-time high early Thursday, breaking above $111,000 and reaffirming its position as the dominant force in digital assets. The milestone, which comes just four months after its previous record, caps weeks of sustained bullish momentum that have pushed investors back into the crypto space.

At its intraday peak on Wednesday, Bitcoin hit $109,500 before easing slightly. Still, the asset remained up nearly 25% over the past month. driven by renewed appetite for high-growth instruments amid improving macroeconomic conditions, the leading digital asset made another upsurge on Thursday morning, hitting the $111,500 mark per Coingecko data.

The rally has been largely fueled by easing U.S. inflation data and a softening in former President Trump’s global trade policies—two developments that have revived interest in risk-on assets from tech stocks to cryptocurrencies.

Bitcoin, long considered a hedge against monetary instability, is benefiting from growing doubts around the long-term strength of the U.S. dollar. As economic outlooks brighten, investors appear increasingly willing to reposition portfolios toward alternative stores of value.

Bitcoin Rebounds Strong After January Sell-Off

Bitcoin’s climb above $111,000 marks a full recovery—and then some—from earlier-year losses that had rattled market confidence.

In January, Bitcoin briefly approached $109,000 on optimism tied to President Trump’s pro-crypto stance. However, concerns over inflationary trade policies and geopolitical instability soon sent the market into retreat. Bitcoin fell below $75,000, and broader risk assets followed.

But recent macro developments have triggered a turnaround. Cooling inflation figures and a softening stance on tariffs have helped ease investor concerns. The result: a rotation back into growth sectors, including digital assets.

“Mid to long term, if everything just stays in this direction, there will be a Bitcoin over $300,000, $400,000, $500,000,” Coinrock’s Matthias said in last week’s episode of the Coinrock show.

“With Bitcoin, you put yourself in a position that increases the chances of winning. Simple as that. And versus the tourists who left in January and then will come back when Bitcoin is at $165,000 and everything’s pumping and they’ll be like, hey, should I buy Bitcoin?”

Altcoins have surged in tandem. Ethereum and Solana both posted 4% gains, while Cardano rose 5% and Dogecoin jumped 6%, reflecting renewed retail enthusiasm.

ETF Inflows and Institutional Buys Fuel Surge

Bitcoin’s rise is being accelerated by a dramatic uptick in spot ETF demand. According to Farside Investors, nearly $1 billion flowed into Bitcoin ETFs during the first two trading days of the week alone—marking one of the strongest showings since ETF approvals in early 2024.

Institutional adoption is also gathering pace. Strategy (formerly MicroStrategy) and Japan’s Metaplanet have continued expanding their Bitcoin reserves, signaling deepening conviction among large asset holders.

These combined forces—positive macro tailwinds, institutional interest, and rising ETF flows—have created a perfect storm for Bitcoin’s upward momentum.

Quick Facts

- Bitcoin hit an all-time high of $111,500 in the early hours of Thursday morning.

- Renewed optimism stems from cooling inflation and softer U.S. trade policy.

- Nearly $1B flowed into Bitcoin ETFs in just two trading days this week.

- Altcoins also rallied: Ethereum and Solana gained 4%, Dogecoin surged 6%.