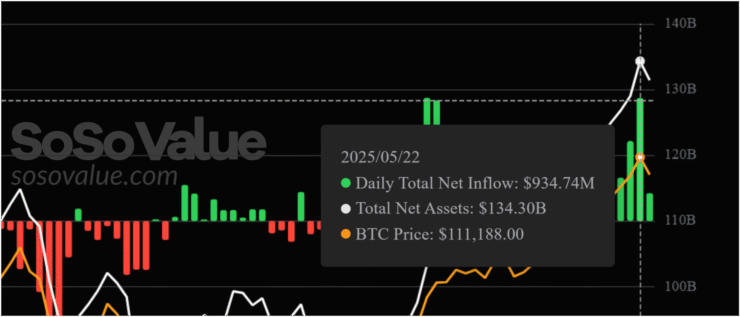

Investor appetite for crypto-backed ETFs has surged to its highest point in months, with Bitcoin and Ethereum funds collectively drawing over $1 billion in inflows on Thursday. The figure marks the largest single-day combined ETF inflow in five months, signaling renewed institutional confidence amid a broader crypto market rally.

BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows with a staggering $877 million in net additions—its third-largest daily tally on record. In total, Bitcoin ETFs attracted roughly $935 million in new capital, according to asset manager Farside Investors.

Analysts say this momentum reflects a growing consensus that Bitcoin has cemented its role in traditional portfolios.

“This isn’t just a one-off,” said Sumit Roy, senior ETF analyst at ETF.com.

“It’s a continuation of momentum we’ve seen especially in IBIT, which hasn’t posted a single outflow since April 9—the same day Bitcoin touched its recent local low.”

Bitcoin has recently breached a new all-time high above $111,000, fueling investor optimism and triggering large capital flows. Roy emphasized that the price strength and ETF demand are closely linked. “There’s a clear correlation between strong price action and ETF flows. As Bitcoin continues to push new highs, we expect that trend to persist.”

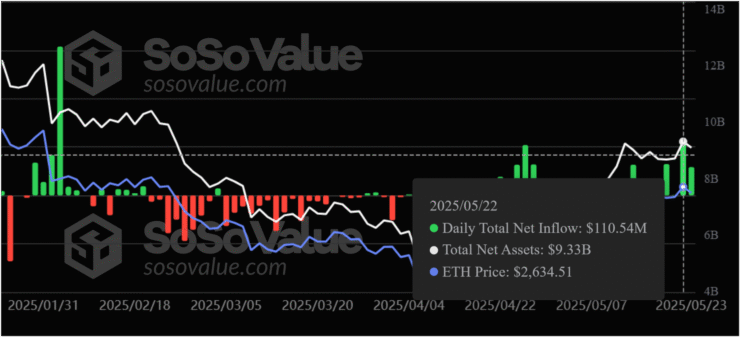

Ethereum ETFs also posted solid gains, drawing more than $110 million in inflows for the day. The activity was led by Grayscale’s ETHE and Fidelity’s FETH, each bringing in over $40 million. The surge reflects growing institutional interest in diversifying beyond Bitcoin—particularly ahead of potential regulatory shifts that could expand access to Ethereum-linked financial products.

Bitcoin Rally Drives Inflows as Institutions Seek Safe Havens

Bitcoin has gained more than 48% since dipping below $75,000 in early April. Analysts attribute the resurgence to cooling U.S. inflation, reduced trade policy uncertainty under President Donald Trump, and heightened interest in alternative hedging assets.

IBIT has become the epicenter of this wave. The fund has amassed over $1.9 billion in inflows in just four trading days this week alone. It’s the third time in the past month that IBIT has cleared $1 billion in a single week. Previous weekly inflow highs included $2.4 billion during the final week of April and just over $1 billion the week after.

Since launching in January 2024, IBIT has now accumulated $41 billion in net inflows—more than quadruple the total of Fidelity’s Wise Origin Bitcoin Trust (FBTC), its closest competitor.

Institutional adoption continues to expand, with analysts noting that Bitcoin is now being viewed not as a fringe speculation but as a legitimate macro allocation strategy—especially in an environment where monetary and geopolitical risks remain elevated.

Ethereum Rebounds as ETF Interest Picks Up

While Bitcoin remains the headline asset, Ethereum is quietly regaining ground. ETH-focused ETFs drew in more than $110 million on Thursday, with strong performances from Grayscale’s ETHE and Fidelity’s FETH.

Ethereum has now climbed 46% over the past 30 days, outpacing most large-cap tokens despite trailing Bitcoin for much of the year. It is currently trading near $2,565, after a modest 3.5% decline from Thursday’s highs.

The inflow activity suggests institutions are rotating into Ethereum amid speculation around new product approvals, network upgrades, and evolving use cases that continue to distinguish ETH as a programmable asset with long-term utility.

Quick Facts

- Bitcoin and Ethereum ETFs recorded over $1 billion in net inflows on Thursday.

- BlackRock’s iShares Bitcoin Trust (IBIT) led with $877 million—the third-largest daily inflow in its history.

- Bitcoin has gained over 48% since early April, hitting an all-time high of $111,814.

- Ethereum ETFs brought in more than $110 million, led by Grayscale’s ETHE and Fidelity’s FETH.

- IBIT has now surpassed $41 billion in total net inflows since launching in January 2024.