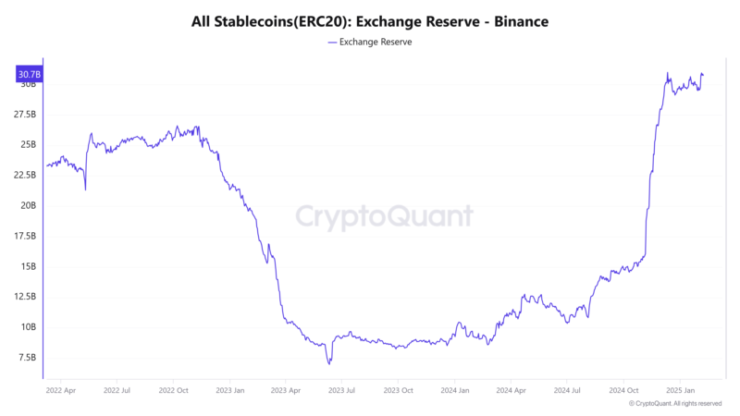

Stablecoin reserves on Binance have reached an all-time high of $31.3 billion, signaling a potential shift in market activity. The surge in reserves suggests investors are moving liquidity onto the platform, often a precursor to heightened trading activity and price fluctuations in major cryptocurrencies.

Binance, the world’s largest crypto exchange by trading volume, has historically seen stablecoin reserves spike before major market moves. There are two primary factors behind this trend:

First, investors may position themselves for large-scale trades, indicating increased confidence in Binance and the broader crypto market. A buildup of stablecoin liquidity often precedes buying pressure on assets like Bitcoin and Ethereum.

Second, Binance could be scaling up its stablecoin supply to meet rising demand from traders. With increased market participation, exchanges often expand their reserves to maintain liquidity and facilitate smooth trading.

Historical data suggests spikes in stablecoin reserves have frequently preceded bullish momentum for Bitcoin and other digital assets. If this trend holds, Binance’s rising stablecoin holdings could signal an imminent wave of trading activity across the market.

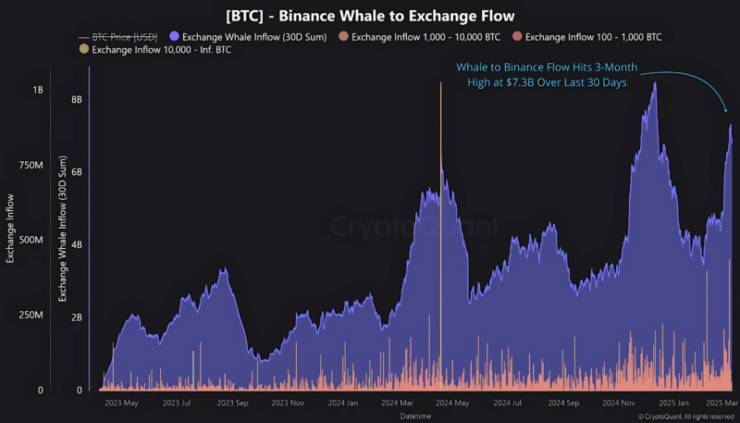

Whale Activity and Market Dynamics

Data from CryptoQuant shows that Bitcoin whale inflows to Binance have surged to $7.3 billion over the past 30 days, marking the highest level in three months. This massive accumulation by large holders has historically been a strong indicator of upcoming price movements and increased market confidence.

When whales accumulate Bitcoin, it often leads to greater price stability and potential market growth, as large investors tend to hold assets for extended periods. However, such movements rarely happen without a catalyst.

The timing of this influx aligns with Donald Trump’s recent announcement of a U.S. Strategic Bitcoin Reserve. This policy move has further fueled speculation about the long-term role of Bitcoin in institutional and government portfolios.

With whale accumulation and Binance’s rising stablecoin reserves signaling increased liquidity, market participants are closely watching for potential shifts in Bitcoin’s trajectory.

Whether this momentum translates into a sustained rally remains to be seen, but the signs suggest that major investors are positioning themselves for a significant move ahead.

Bitcoin’s Current Volatility

Bitcoin’s price has experienced fluctuations in recent weeks, influenced by various market factors. As of the latest data, Bitcoin traded at $85,743, reflecting a 0.72% decrease over 24 hours.

The cryptocurrency market continues to grapple with uncertainty, with whale activities and stablecoin reserves playing pivotal roles in shaping investor sentiment and potential market trajectories.

Quick Facts:

- Record Reserves: Binance’s stablecoin reserves have surpassed $31.3 billion, indicating a substantial liquidity influx.

- Whale Movements: Large Bitcoin holders have deposited over $7.3 billion to Binance in the past month, reaching a three-month peak.

- Market Implications: Elevated stablecoin reserves and increased whale activity could signal upcoming shifts in the cryptocurrency market