Binance has permanently banned a market maker involved in manipulative activities surrounding GoPlus Security (GPS) and MyShell (SHELL) tokens. The decision follows an internal investigation that revealed violations of Binance’s market-making policies, including failure to maintain balanced buy and sell orders and insufficient liquidity provision.

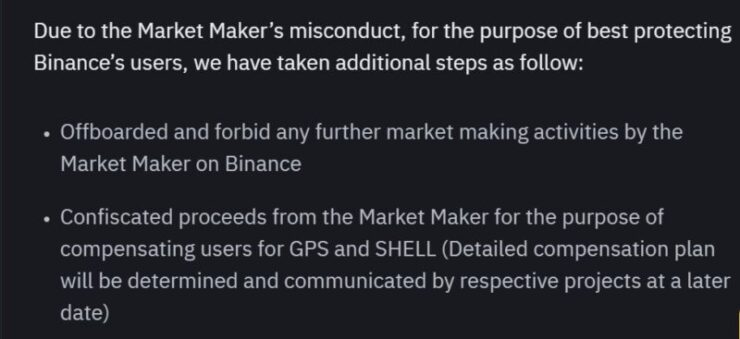

In a statement released Sunday, Binance announced that it had offboarded the market maker and confiscated its illicit profits, which will be redistributed to compensate affected GPS and SHELL holders. The details of this compensation plan are expected to be disclosed in the coming days.

The investigation found that the banned market maker’s actions led to a $5 million liquidity imbalance, negatively impacting the GPS and SHELL token markets. Binance, known for its strict compliance measures, acted swiftly to protect users from further instability caused by market manipulation and improper trading practices.

“Any project-authorized market makers who do not comply with or breach such principles and rules, Binance will take further actions against such market makers to best protect our users,” the release stated.

What is a Market Maker and How Do They Operate?

A market maker is an entity—typically a trading firm or financial institution—that provides liquidity to a market by continuously placing buy and sell orders. Their role is essential in reducing price volatility, ensuring that assets can be bought or sold quickly without significant price fluctuations.

Market makers profit from the bid-ask spread, the difference between the price they are willing to buy (bid) and sell (ask) an asset. In the crypto industry, automated algorithms enable market makers to execute high-frequency trades, stabilizing prices while benefiting from small, rapid trades.

However, market makers must adhere to strict rules to avoid manipulative practices, such as wash trading, excessive order cancellations, or price distortion—all of which can create false market activity and mislead investors. When violations occur, as seen in Binance’s recent ban, exchanges step in to maintain market integrity and protect traders.

Violations of Binance’s Market Rules

According to on-chain analyst “Ai 姨”, 300 million GPS tokens—located outside of Binance—were allocated for market-making purposes. However, instead of balancing buy and sell orders, the market maker dumped 70 million tokens within the first 21 hours of listing, pocketing a $5 million profit without engaging in any buy-side activity.

The findings further indicate that the market maker engaged in high-frequency order placements and cancellations, tactics commonly used to manipulate liquidity artificially. These practices disrupt market stability, creating an illusion of trading volume while undermining fair price discovery.

Market Reacts to Binance’s Crackdown

According to CoinGecko data, GPS plunged by over 11%, reflecting investor uncertainty, while SHELL initially dipped to $0.26 before rebounding 6.5%.

In a related development, Binance recently announced a new token listing and delisting mechanism designed to increase community participation in shaping the exchange’s trading landscape. Under the new system, users holding at least 0.01 BNB will be able to vote on which tokens should be listed or removed from Binance’s trading platform.

While this empowers users, Binance will retain final authority over which tokens make it to the voting pool. This ensures that compliance, liquidity, and security standards remain a priority, even as the exchange shifts toward a more community-driven governance model.

Quick Facts:

- Binance banned a market maker for engaging in manipulative trading practices involving GPS and SHELL tokens.

- Confiscated profits from the market maker will be used to compensate affected users, with details forthcoming.

- The GPS token’s price dropped over 14% following the announcement, while SHELL showed initial decline but signs of recovery.