Crypto-friendly billionaire Bill Ackman believes U.S. President Donald Trump may hit the brakes on his sweeping new tariffs. In a statement shared just two days before the next round of tariffs are scheduled to take effect, Ackman warned that rushing the policy could risk tipping the economy into a severe recession.

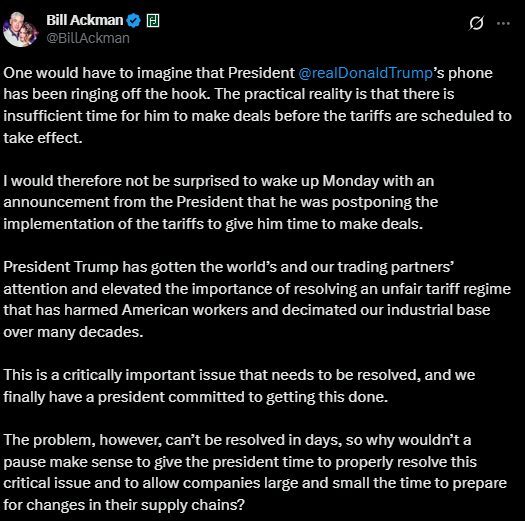

Ackman, founder of Pershing Square Capital Management, took to X on April 5 to share his outlook. He speculated that Trump, faced with mounting pressure and limited time to negotiate, might choose to postpone the tariff implementation in order to strike better trade deals and soften the economic impact.

“One would have to imagine that President Donald Trump’s phone has been ringing off the hook,” Ackman wrote. “There is insufficient time for him to make deals before the tariffs are scheduled to take effect.”

Trump’s controversial executive order, signed on April 2, sets a baseline 10% tariff on all imports and introduces “reciprocal” tariffs aimed at countries with their own trade barriers against the U.S. The order’s first phase took effect on April 5.

But the second wave, harsher tariffs on nations with the largest trade deficits is expected to roll out on April 9, drawing concern from economists and investors worldwide.

Ackman: Tariff Pause Is Not Just Possible, It’s Smart

Ackman emphasized that delaying the tariffs could be a strategic and necessary move for Trump, not only to continue negotiations but to prevent market panic and economic dislocation.

“I would not be surprised to wake up Monday with an announcement from the President that he was postponing the implementation of the tariffs,” Ackman wrote.

He also pointed out the need for businesses—large and small—to have adequate time to prepare for such sweeping changes.

“The risk of not doing so is that the massive increase in uncertainty drives the economy into a recession, potentially a severe one.”

Since the April 2 announcement, U.S. stock markets have tumbled sharply, shedding more value during the April 4 session than the entire crypto market is currently worth. That dramatic contrast didn’t go unnoticed.

While Wall Street panicked, crypto markets remained relatively steady. This stability was especially noteworthy to observers who have long viewed crypto as a volatile, high-risk asset class.

Ackman, who declared that “crypto is here to stay” following the FTX collapse—has remained an outspoken supporter of digital assets. The fact that crypto held up better than traditional equities this past week reinforces that view for both skeptics and believers.

Prominent figures in the crypto space have echoed Ackman’s support for parts of Trump’s approach. BitMEX co-founder Arthur Hayes and Gemini co-founder Cameron Winklevoss both voiced their support for the tariff initiative, framing it as a necessary rebalancing of unfair global trade practices.

Ackman himself called the existing system an “unfair tariff regime” that has harmed American workers and industries for decades. While he backed the idea of tariffs, he made clear that timing and execution matter.

A Critical Decision Looms

With additional tariffs set to kick in on April 9, all eyes are now on April 7. Ackman called it “one of the more interesting days in U.S. economic history,” signaling that the next 48 hours could be pivotal.

Whether Trump stays the course or takes a tactical pause, the global economy and the crypto market in particular—will be watching closely.