Quick Facts:

- Rumors surfaced that Base was selling ETH collected from its sequencer, but Base has denied these claims.

- The Base team clarified that ETH transfers to Coinbase Custody were for security and auditing purposes only.

- Critics argue that sending sequencing fees to centralized exchanges contradict Ethereum’s decentralized vision.

The Base development team has pushed back against rumors that its sequencer is offloading Ethereum (ETH) on the open market, clarifying that recent transfers to Coinbase Custody were strictly for security and auditing purposes.

The Ethereum Layer 2 scaling solution Base came under community scrutiny following revelations that its sequencer fee earnings are being entirely transferred to Coinbase.

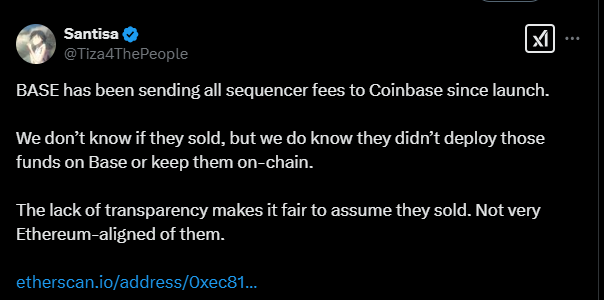

The concerns were first flagged by Santisa, the pseudonymous chief investment officer of Lucidity, who posted on X that Base has been sending its total sequencer revenue directly to Coinbase. Santisa backed the claim with on-chain data from Etherscan, showing consistent transfers of ETH from Base’s sequencer wallet to Coinbase, including a recent 240 ETH transaction.

This discovery fueled speculation about whether Base was selling its sequencer fee earnings, leading to calls for greater transparency regarding how the funds are managed and utilized.

Base Responds, Defends Ethereum Commitment

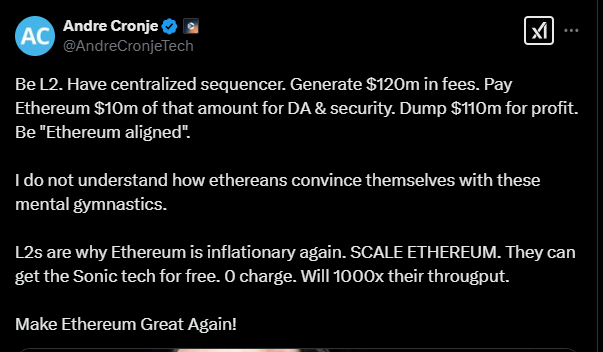

Santisa’s revelation drew criticism from rival blockchain developers, including Andre Cronje, co-founder of Sonic Labs, who questioned whether Base can truly be considered “Ethereum aligned.”

Cronje argued that while Base has generated an estimated $120 million in fees, it has only paid around $10 million to Ethereum for data availability and security. He alleged that instead of contributing meaningfully to the Ethereum ecosystem, Base was redirecting profits to Coinbase.

Following the backlash, Base’s strategy team member Kabir Sadarangani took to X to address the growing concerns. Sadarangani insisted that Base’s sequencer revenue was being actively reinvested into Ethereum and that the transfers to Coinbase were purely for security and auditing purposes.

“Base is and will continue growing Ethereum. We’re investing all of our earnings and resources into doing this,” Sadarangani wrote.

“Base and Coinbase have and continue to hold ETH and publicly disclose our long term holdings (100K ETH+, $300M+). AFAIK this is the largest ETH holding of any public company and way bigger than any other L2 DAO or Labs company today.”

Despite these assurances, some critics remain skeptical, arguing that Base should publish a more detailed breakdown of how its sequencer revenue is utilized. Others pointed out that relying on Coinbase Custody still introduces a centralization risk, regardless of intent.

Base’s Sequencer Model and the Centralization Debate

The controversy surrounding Base’s sequencer fee transfers to Coinbase has sparked concerns about transparency and decentralization within Ethereum’s Layer 2 ecosystem. Unlike decentralized rollups, Base currently operates with a single centralized sequencer—controlled entirely by Coinbase—which handles transaction bundling and finalization before posting them to Ethereum’s mainnet.

This setup means Coinbase directly benefits from transaction fees, which critics argue creates a potential conflict of interest. In contrast, decentralized rollups distribute sequencer fees collected, to be used for network maintenance and development.