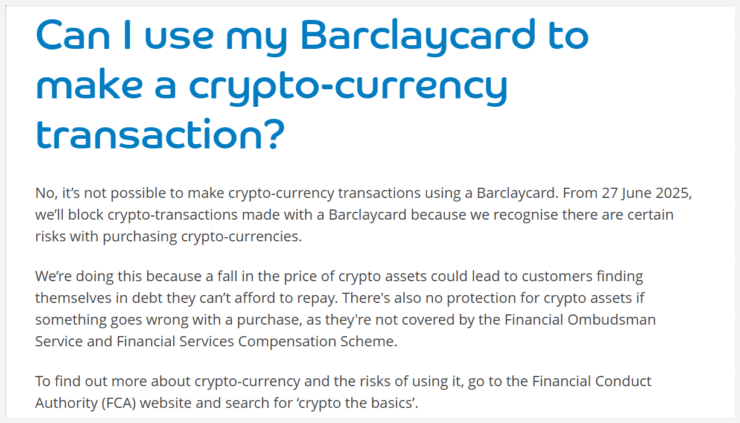

Barclays will begin blocking all crypto purchases via its credit cards starting Friday, June 27, marking a significant policy shift amid growing regulatory scrutiny in the United Kingdom. The bank cited volatility and insufficient investor protections as the main reasons behind the move. According to Barclays, sharp price swings in crypto markets could saddle users with unmanageable debt—especially when purchases are made on credit.

In a statement on its website, the bank warned that digital asset purchases are not protected by the Financial Ombudsman Service or the Financial Services Compensation Scheme, meaning customers have little recourse if something goes wrong. The bank’s decision comes just as the UK financial sector intensifies discussions on whether buying cryptocurrencies with credit cards poses unacceptable risks to consumers.

Longstanding Access Ends as UK Weighs Tighter Oversight

Barclays has allowed crypto transactions through Barclaycard since at least 2018, supporting customers who use credit to access digital asset exchanges. With over 5 million credit card holders in the UK, the policy change is likely to affect a broad segment of retail investors.

The bank’s move mirrors a growing debate over consumer protections in the crypto space. Earlier this year, the UK Financial Conduct Authority (FCA) published a consultation paper raising the question of whether further restrictions should be applied to crypto purchases made with borrowed funds. Although not yet binding, the FCA’s inquiry is shaping the stance of financial institutions like Barclays that are taking preemptive action.

Trade Group Pushes Back Against Blanket Restrictions

The Payments Association, a London-based industry group, has criticized the growing momentum toward credit-card bans in crypto, arguing that such measures unfairly equate digital assets with gambling. In its formal response to the FCA’s consultation, the group said that consumers should be allowed to make informed financial choices under clear limits, rather than face blanket prohibitions.

The association also emphasized that banks already possess tools to mitigate credit risk, including limits on high-risk transactions and selective blocks on crypto purchases. However, it acknowledged that credit card crypto buys come with hidden costs—such as being treated as cash advances by some issuers, triggering higher fees and interest rates.

Quick Facts

- Barclays will ban crypto transactions made with credit cards starting June 28.

- The decision follows concerns about volatility, investor debt, and lack of regulatory protection.

- The FCA is evaluating broader restrictions on credit-funded crypto purchases across the UK.

- The Payments Association has warned against treating crypto like gambling, urging for balanced consumer controls.