Quick Facts:

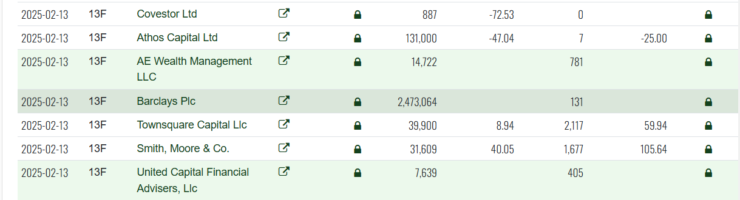

- Barclays has disclosed a new holding of 2,473,064 shares in BlackRock’s iShares Bitcoin Trust (IBIT)

- The shares are valued at $131.2 million, according to its latest SEC 13F filing for Q4 2024

- The IBIT investment represents only about 0.04% of Barclays’ $356.9 billion portfolio

Barclays has entered a significant new position in BlackRock’s iShares Bitcoin Trust (IBIT), purchasing 2,473,064 shares valued at $131.2 million, according to its latest SEC 13F filing for Q4 2024. Barclays’ investment signals a move away from its previous stake in Grayscale’s Bitcoin Mini Trust.

The move follows Donald Trump’s pro-crypto policy push after his re-election in November 2024, reflecting the growing institutional interest in spot Bitcoin ETFs spurred by the expectations of a favourable atmosphere for Digital assets and their related products, from the new government. Despite the notable allocation, the IBIT investment represents only about 0.04% of Barclays’ $356.9 billion portfolio as of December 31, 2024.

Barclays’ $131 million investment in BlackRock’s iShares Bitcoin Trust (IBIT) was disclosed in a 13F filing with the SEC for Q4 2024. A 13F filing is a quarterly report that U.S. institutional investment managers with over $100 million in assets must submit, providing a snapshot of their holdings in U.S. equities and related options.

However, 13F filings only disclose long positions and exclude short positions and non-equity assets, meaning they offer a limited view of an institution’s overall strategy. This implies that Barclays’ total Bitcoin-related exposure may extend beyond what is reported in IBIT shares alone.

Institutional Giants Drive Record Inflows into Bitcoin ETFs

Barclays’ $131 million acquisition of IBIT shares has positioned it among the top 10 institutional holders of BlackRock’s Bitcoin ETF, according to Fintel data. The largest known IBIT holder is Goldman Sachs, which owns over 24 million shares valued at approximately $1.3 billion, alongside $294 million in Fidelity’s FBTC, bringing its total Bitcoin ETF exposure to over $1.6 billion.

Other notable IBIT investors include Tudor Investment Corporation, DRW Securities, and the State of Wisconsin Investment Board, indicating growing institutional confidence in spot Bitcoin ETFs.

The strong demand for Bitcoin ETFs is reflected in January’s record inflows, with BlackRock’s IBIT leading the pack with $3.2 billion in new investments, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with nearly $1.3 billion in inflows.

This surge in institutional investment coincided with Bitcoin hitting a new record high of $109,000 just before the U.S. presidential inauguration. While analysts see Bitcoin surging to $200,000, market conditions and regulatory developments will play a crucial role. Investors should watch for potential policy shifts and market corrections that could influence ETF inflows